Today, the OCOLO team is hard at work poring over the recently published RBC Datacenter Download – Global Review of Financial, Strategic and Operating Topics report, compiled by collaborators from the insightful equity research teams at RBC Capital Markets, LLC, Research Division, RBC Dominion Securities and Royal Bank of Canada (Sydney Branch). We at OCOLO follow Jonathan Atkin and his team’s datacenter industry research closely and our fearless leader, OCOLO‘s co-founder and CEO, Tony Rossabi, is aligned with many of his views on where the puck is headed.

This data- and content-rich 300-page report spans datacenters of all sizes and all financial, political, operating and environmental aspects of the industry, so as with other sophisticated equity research the OCOLO team has taken on, we’re going to chunk it up for you and quote liberally! The language is mostly verbatim, and unless noted otherwise, the source for all exhibits is the report itself.

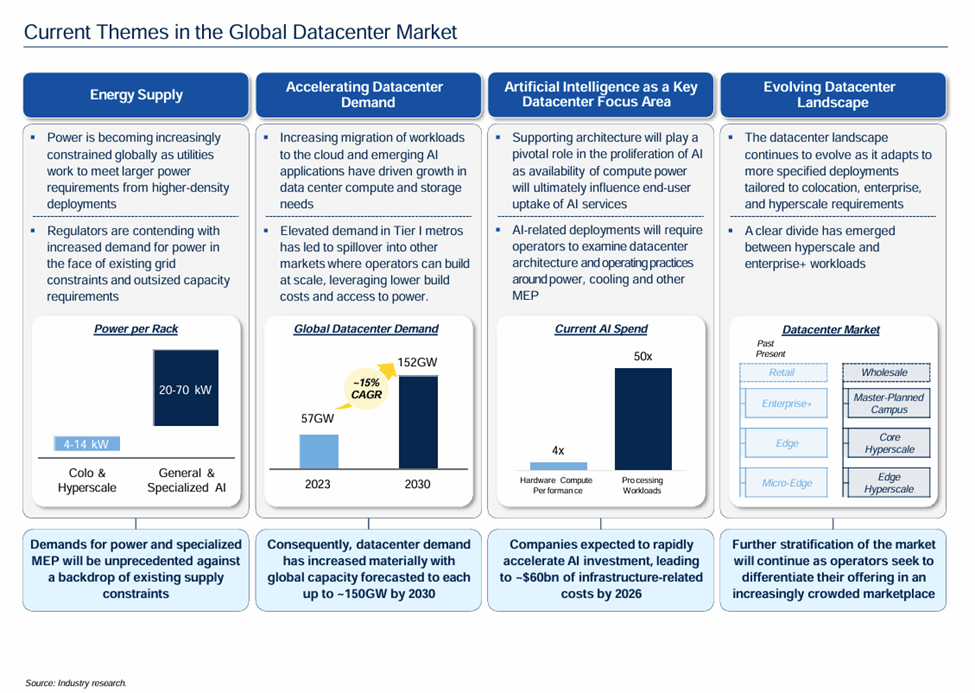

Today, we’ll tackle current themes in the global datacenter space.

Key Takeaways:

Energy supply

RBC’s Utilities team finds that datacenters will represent half of the U.S. power demand growth through 2026, increasing forecasts by more than 50% in some regions. Furthermore, demand should accelerate beyond 2026 as the grid tries to catch up to a large backlog of projects.

Accelerating datacenter demand

Datacenter supply should remain tight, amidst strong demand from cloud computing, generative AI, social networking, software, and other verticals. By region, the report estimates ongoing developments totaling 2.3 GW in EMEA, 5.0 GW in APAC, and 5.0 GW in the Americas, excluding self-builds.

AI as a key DC focus area

Generative AI is becoming a noticeable tailwind to reported cloud revenues. For AWS and Google, the report estimates GenAI comprises a low-single-digit percentage of cloud revenues, and for Microsoft, notably higher at 7%.

The team expects these mixes to increase materially, supported by the GenAI infrastructure investment apparent in datacenter leasing across the U.S., EMEA and APAC.

Cloud resource utilization is expanding due to both large AI model builders and smaller firms leveraging the cloud for training AI foundation models, with a future emphasis on AI inference.

Evolving DC landscape

Energy-related and permitting constraints across many metros, coupled with long lead times on datacenter equipment and construction, are limiting the velocity at which new supply is coming online. This in turn should drive continued favorable pricing and renewal spreads for those developers who are able to secure resources.

As energy transmission constraints are addressed, a process that can take up to several years, energy-related supply constraints could lessen over the medium to longer term.

The team has not seen a notable shift in the mix of hyperscale build vs. lease behavior. Given challenges around several hyperscalers’ campus-scale projects, particularly in near major metros, they anticipate demand at third-party developers will remain elevated.

Next up

We’ll share the most frequently asked-about topics the RBC Capital Markets, LLC, Research Division equity research team covering all aspects of the DC space encounter in their interactions with company management, investors and industry experts.

Again, many thanks to the team for producing this compelling research:

RBC Capital Markets, LLC, Research Division: Jonathan Atkin, Bora Lee, Rashim Jain