The folks at Visual Capitalist are out with a new infographic today addressing the impact of AI spending on a plethora of global industries. This one looks at how investing in AI can affect industry margins on average over the next five years. As usual, the OCOLO team found the info fascinating… and intriguing enough to poke around for even more context on the topic.

The first thing we learned is that the reference data for this infographic comes from a larger report published recently by the Bank of America Institute called “AI: From evolution to revolution,” covering the much broader long-term implications of AI implications on business and the economy. Stay tuned for more content from that report in future posts.

As for the methodology behind this infographic, Bank of America surveyed more than 150 of their Global Research equity analysts and macro strategists on AI’s impact on the approximately 3,400 companies under coverage with an aggregate market cap of ~$90 trillion.

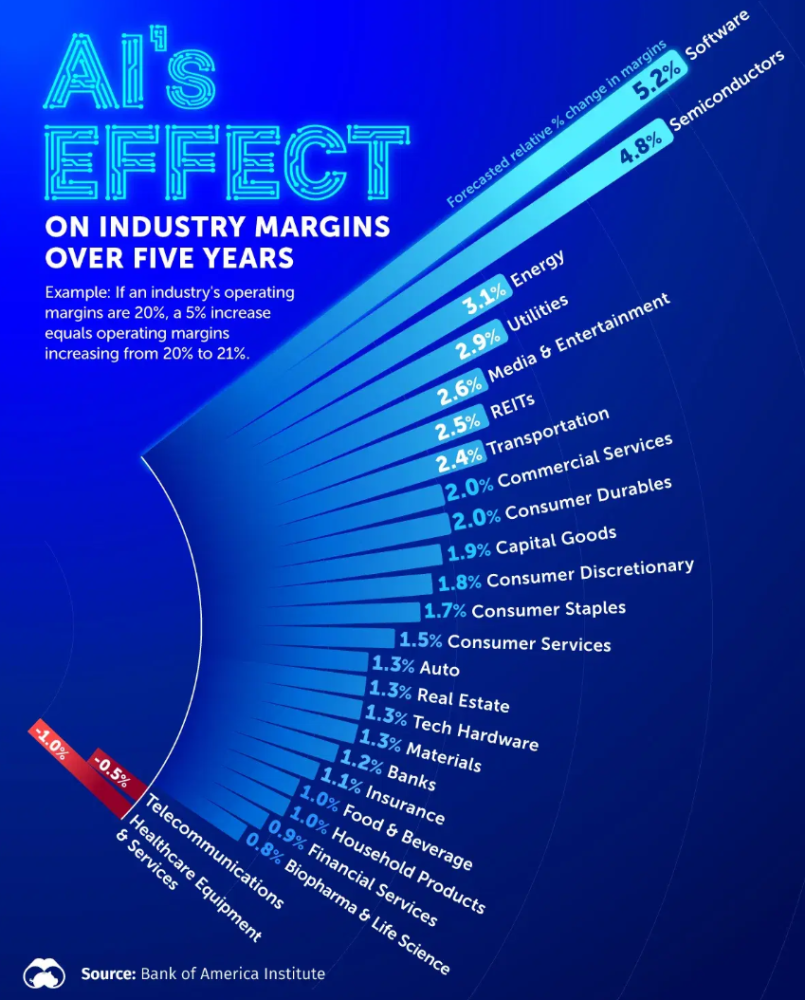

Surveyed analysts expect AI to drive margin expansion for 23 of the 25 industry groups globally

Overall, they found that enterprise AI implementations are moving from pilots to production, which could boost S&P operating margins by 200 basis points (bps) over the next five years, equivalent to approximately $55 billion in cost savings, annually.

And the winners are…

The infographic singled out the top 7 industries with a positive impact of greater than +2% margin impact over 5 years in the visual:

1. Software: +5.2%

2. Semiconductors: +4.8%

3. Energy: +3.1%

4. Utilities: +2.9%

5. Media & Entertainment: +2.6%

6. Real Estate Investment Trusts (REITs): +2.5%

7. Transportation: +2.4%

We also thought it might be helpful to point out just what these percentages are referring to: they are NOT percentage point increases in margins, they are percentage amount increases.

So to clarify, and use an example similar to the one used in the infographic: If a software company has a 20% operating margin today, that margin may increase 5% to 21% within the next 5 years as a result of implementing AI, not 5 percentage points to 25%. (Some of us are bigger smartie pants than others… just sayin’).

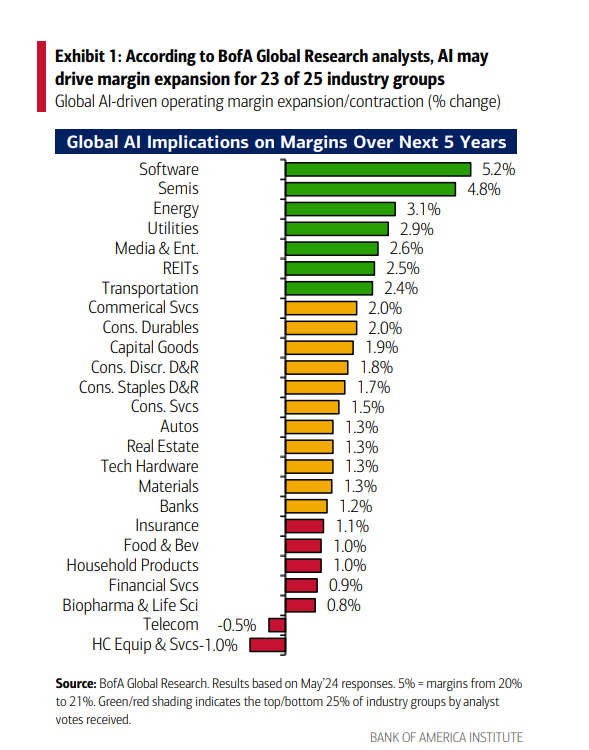

For another view, this is how the Bank of America Institute note shows the margin impact from best to worst, which raises a host of other questions, like: why are sectors like Financial Services, Biopharma & Life Sciences, Telecom and Health Care Equipment & Services expected to have minimal to negative margin impact from the significant funds they’re pouring into AI? JPMorganChase, for example, which is scheduled to report Q3 earnings tomorrow, has allocated between $5-10 billion of their $15 billion IT budget to AI capex over the last two years, and is only accelerating spend in this area. Obviously, Jamie Dimon is playing a much longer game than 5 years with his AI strategy. It will be interesting to hear what he has to say on the earnings call.

Conventional wisdom suggests that the lag between capex and margin expansion when it is aimed at a combination of capacity expansion, efficiency gains and automation is anywhere from 12 to 36 months, depending on market conditions, demand for certain products and economic cycles.

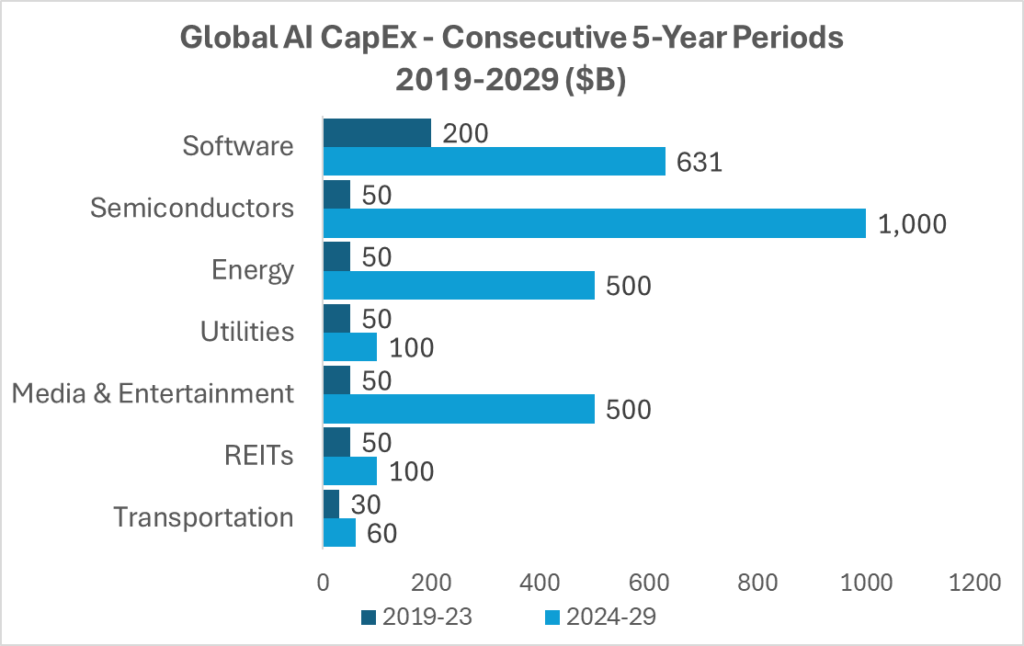

Looking at the industries with margin improvements – which, honestly, look nice but nothing like the boffo numbers we keep hearing about in terms of AI capex across all industries – we wondered what they’re actually spending to realize these margin gains.

Combing industry statistics, we found that the top 7 industries by potential margin gains spent a combined $480 billion on AI CapEx between 2019-23…and are estimated to spend an eye-popping $2.9 trillion between 2024-29!

Clearly, the “spend money to make money” theory is in full effect at the top of the list of potential margin gainers. Global software spend is expected to more than triple between 2024-29 vs the prior 5 year period to $630 billion. Semiconductor industry AI spend, not surprisingly will surge from $50 billion to an estimated $1 trillion thanks to gen AI. Energy and Media & Entertainment AI CapEx will grow 10X during that time and Utilities, REITs and Transportation spend will double.

So the net-net: investing in AI is certainly an expensive and long-term proposition, but there is no doubt that the wait is not long to start realizing the returns on the investment and that they’re guaranteed to compound over time.

We’ll be back with more insights from the Bank of America Institute report, as well as thoughts on JPMorganChase Q3 earnings comments vis a vis AI CapEx.

In the meantime, many thanks to the Bank of America Institute AI report contributors: Vanessa LeBlanc Cook, Alkesh Shah, Andrew Moss, Ritesh Samadhiya, CFA and Haim Israel.