Seeking the source material yesterday for the visual the Guggenheim Securities Telecom & Digital Infrastructure Investment Banking Team used in its March Telecom & Digital Infrastructure Market Update that we featured in yesterday’s post led the OCOLO team to a great research find: Barclays Investment Bank‘s Impact Series report: AI revolution: Meeting massive AI infrastructure demands.

This is the 13th in a multi-year series of in-depth reports Barclays Research has been publishing for years that explore the social impact of economic, demographic and disruptive changes affecting markets, sectors and society at large. Each report distinguishes Barclays Research’s views on the topic from widely held views, while at the same time delivering insights from an array of sources to deepen readers’ understanding.

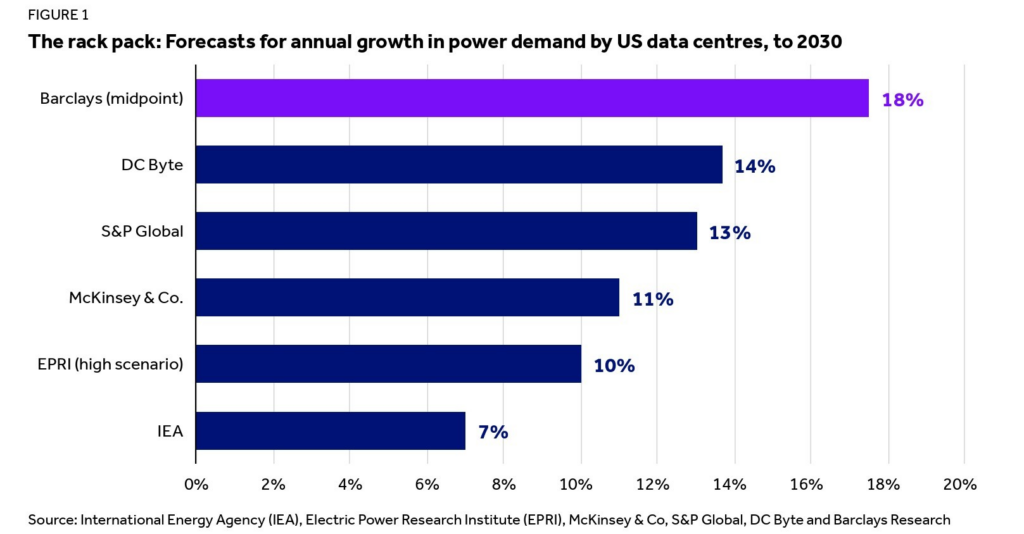

Today, we’ll look at how and why the team’s forecast for annual growth in power demand by US data centers through 2030 is so much higher than the most frequently cited estimates in the market today. See below.

At 18%, the team’s midpoint estimate exceeds its next closest competitor, DC Byte, by 4 percentage points. It surpasses the Electric Power Research Institute’s (EPRI) high scenario by 8 percentage points and is more than double that of the International Energy Agency (IEA). It’s also important to note that this forecast excludes cryptocurrencies, which the IEA estimates accounted for 1-1.5% of world electricity consumption as of mid-2024, ~4% of the US and 3% of the EU, where the majority of the world’s 11,000 registered data centers are located.

The team rationalizes their higher power demand estimates to… you guessed it…the rapid proliferation of AI. More specifically, its view is that others may be underestimating how dramatically data centers’ energy demands could change in coming years as AI disseminates more broadly. The report characterizes data centers as “AI factories” that serve a multitude of power-hungry functions, including training and operating models and warehousing and distributing data for applications, websites, services and cloud computing.

Using a bottom-up approach based on utilities’ forward-looking supply contracts, Barclays Research estimates that annual demand to power data centers in the US could grow by a range of 14-21% every year through 2030.

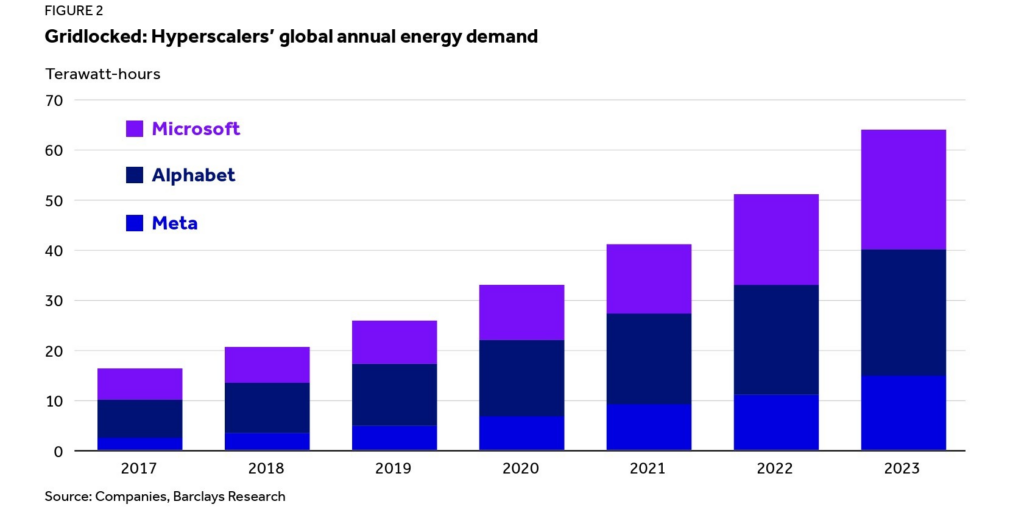

By their calculations, that puts US data center demand tripling by 2030, from 150-175 TWh in 2023 to 560 TWh by 2030, again, excluding crypto. According to the report, combined global power demand from Alphabet Inc., Meta and Microsoft has grown at an average of 25% or more each year since 2017 – and will only accelerate with ongoing AI proliferation – not only eclipsing prior growth targets, but also imperiling net-zero targets made with very different, pre-AI assumptions.

So, who’s right? How much will demand grow from here? Interesting questions to ponder, especially once we factor in crypto, which the US Energy Information Association estimated at 0.6-2.3% of US electricity consumption in 2023 and is surely multiples of that by now given massive growth in the sector.

The Barclays report also delves into how different countries are using geostrategy to tackle data center construction and evaluates various energy sources as long-term viable alternatives to traditional power. We’ll look at these topics in future posts.