Recently, the murmurings have been getting louder that the massive sums that hyperscalers are plowing into AI capex not only exceed what the growth opportunity might support, but in fact may be masking a downturn in overall tech capital investment. Are other equally important areas of growth and innovation suffering as these tech juggernauts place all their chips on AI?

We saw a few companies get dinged during the most recent round of quarterly earnings based on capex relative to revenue and EBITDA growth and outlook. In particular, Amazon, Microsoft and Google faced tough questions from analysts and investors on the pressure their high AI capex levels are putting on profitability and the uncertainty around timing for both revenue growth and ROIs. Some have wondered whether the fierce AI “Arms Race” hyperscalers are engaged in is setting them up to be stretched in just as we head into an economic slowdown. Is it possible to invest for growth and demonstrate cost discipline at the same time?

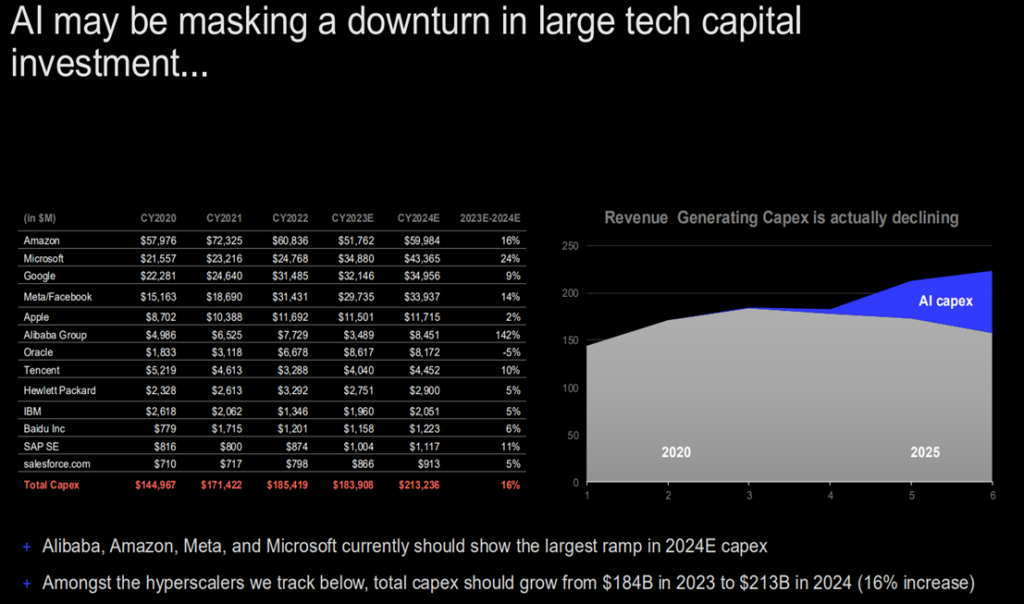

This topic came up at the Pacific Telecommunications Council (PTC) DC conference last week that OCOLO’s CEO, Tony Rossabi, attended as well. It was another key agenda item, along with closing the digital divide, that William Barney, President & Chair of the Pacific Telecommunications Council (PTC) Board of Governors, addressed in his remarks opening the 2-day event. He demonstrated the magnitude of the growth and overall size of AI capex by global hyperscalers using data from RBC Market Research in the below slide:

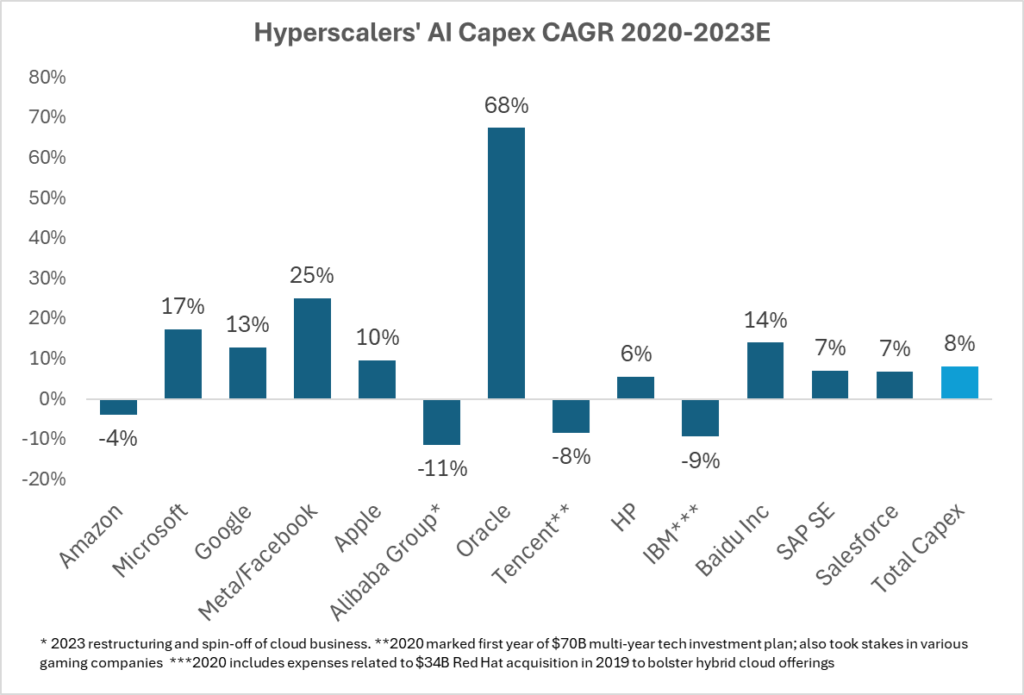

The OCOLO team did a little more noodling with 2020-23 CAGR for these hyperscalers, looking into any anomalies from the years leading into this one in terms of spend.

Looking at 2020-23 CAGR vs. expectations for AI capex in 2024, there are some interesting findings.

- Amazon has spent at a relatively constant pace over the past five years; if anything, its 2023 AI capex was uncharacteristically low, which explains the -4% CAGR. The 16% increase in 2024 represents a return to more normalized spend.

- Similarly, Apple has maintained consistent AI spend of $11 billion-plus for years and shows no sign of slowing down. Just this week, Apple introduced a new iPhone 16 lineup that includes a spate of AI-powered features including writing tools, photo and video enhancements, improvements to Siri and on-device privacy and security settings.

- It hasn’t been straight up and to the right for everyone. After a disastrous few years of intense economic and regulatory pressure in China, Alibaba Group is on track to more than double its AI capex in 2024. Beginning in 2021, Chinese regulators cracked down on the tech sector with new regulations around data security, antitrust and monopolistic practices, creating a much more cautious and uncertain business environment that stifled investment and growth. Meanwhile, competitors like Tencent Cloud, Huawei Cloud and Amazon Web Services (AWS) moved aggressively into the cloud space, further hurting profitability. In May 2023, Alibaba Group announced plans to shut down its Alibaba Cloud division, but instead closed its data centers in Australia and India to focus on its core businesses like e-commerce.

- Analysts, investors and other industry observers aren’t imagining the hyperscalers’ “AI Arms Race” – the 16% average estimated increase in 2024 AI capex is DOUBLE the average AI capex CAGR across the group for 2020-23E.

- As the right-side chart on the slide above shows, stripping out AI capex does send the trajectory of overall capex downward, which is not good news considering this is the ongoing, necessary investment that powers the continued revenue growth and vitality of core and proven businesses.

It will take years to see what the “true” potential scale and return of AI represents across industries and economies. In the meantime, there is a very real danger of overexuberance driving a spending spree that turns into a bubble… and we all know what eventually happens to those. Let’s hope the folks in charge have learned enough lessons of the past to know when to slow the “AI Arms Race” to more of a stroll.

Many thanks to William Barney from Pacific Telecommunications Council (PTC) for sharing the slide and to RBC Market Research for the source data!