The outstanding Research Team at CBRE, the #1 commercial real estate services and investment firm in the world, which manages more than 7 billion square feet of commercial properties in more than 100 countries, is out with Q4 and FY 2024 capacity figures on the primary and secondary markets of Europe. While the region has a lot of catching up to do versus the US and parts of Asia, the growth rates here remain robust.

As a reminder, Europe’s primary data center markets are FLAPD – Frankfurt, London, Amsterdam, Paris and Dublin

Secondary markets include Berlin, Brussels, Madrid, Milan, Munich, Oslo, Stockholm, Warsaw, Vienna and Zurich.

As you can see from the figure below, trends in European data center markets are following the same trajectory of those in the US and other global markets where need is greatest – constrained capacity, particularly in primary markets, even as demand accelerates at unprecedented rates, leaving secondary markets to fill the void as fast as they can.

FLAPD new supply shrunk by 20% in 2024, while take-up was down 13%. At the same time, secondary market supply essentially tripled during the same period, while take-up increased 182%.

Supply

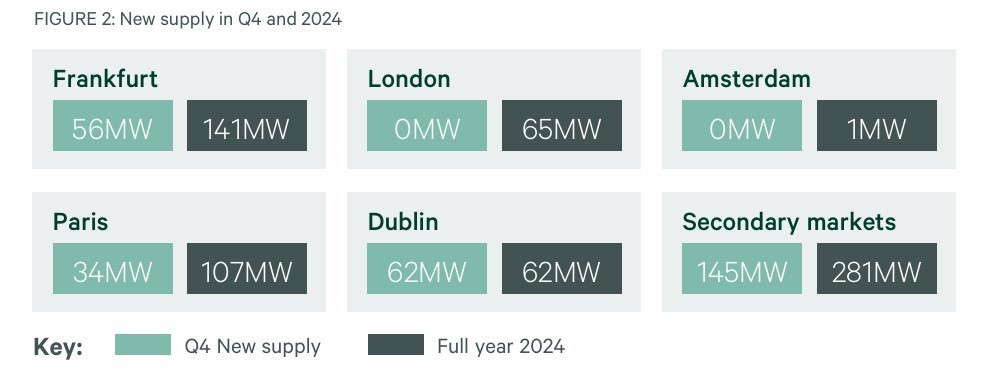

The Figure below shows new supply in Q4 and 2024 in FLAPD and Secondary markets. Providers added a record 655MW of new data center supply in Europe for the full year.

- There were 297MW of new supply recorded in Q4. That was split 51% FLAPD and 49% Secondary markets.

- Dublin had the most supply delivered (62MW), followed by Frankfurt (56MW), and Paris (34MW).

- Another 145MW of new data center capacity were delivered across the secondary markets of Europe in Q4. Oslo and Berlin had the most new supply added of any secondary market in Europe last quarter.

- The annual 655MW new supply total in Europe was 17% higher than the 561MW total in 2023 – a noteworthy increase given how hard DC construction is now with the lack of available power and demand

- Three primary factors are driving double-digit Secondary market supply growth, according to the report: 1) lack of availability in FLAPD, 2) growing demand for wholesale capacity from hyperscalers and 3) data protection/data residency regulation.

In addition, cloud service providers increasingly want to deliver services to local markets from in-country versus in-region, which had expanded growth beyond FLAPD. This, coupled with Enterprises’ desire to outsource their equipment to trusted third parties, has convinced CBRE that 5 out of the 10 secondary European markets will experience double-digit supply growth in 2025 and 7 out of 10, including Milan and Madrid, will have more than 100MW of supply by year-end, up from just 4 at end-2022.

Take-up

According to the report, take-up (341MW) outstripped new supply delivered (297MW) in Q4, owing to strong demand in Paris and Frankfurt. It was the 4th consecutive quarter that take-up of data center capacity exceeded new supply in Europe.

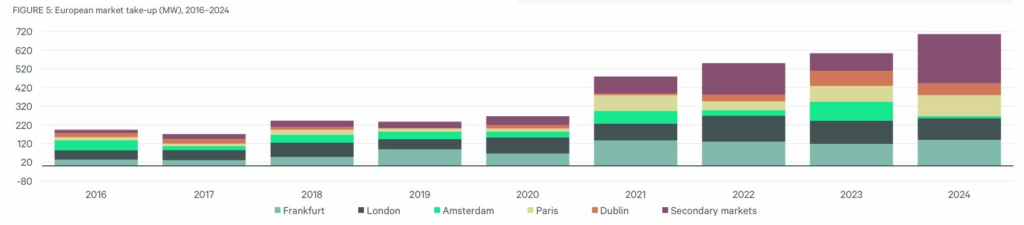

- As the figure below shows, there were 706MW of take-up recorded last year – a new take-up record for Europe for the 7th consecutive year.

- Expansion of hyperscaler cloud regions remains the top driver of demand for space in Europe.

- Demand is also expected to grow given the need for AI-specific capacity from emerging providers and hyperscalers.

However, the report also points out that a distinct lack of AI-ready facilities and a shortage of available power and land in FLAPD markets may lead more providers to build data centers in markets where there are not any data centers or where there is little data center activity of consequence. Remember: AI training centers do not need to be located in traditional Tier 1 data center markets, which opens up a whole new range of geographic possibilities.

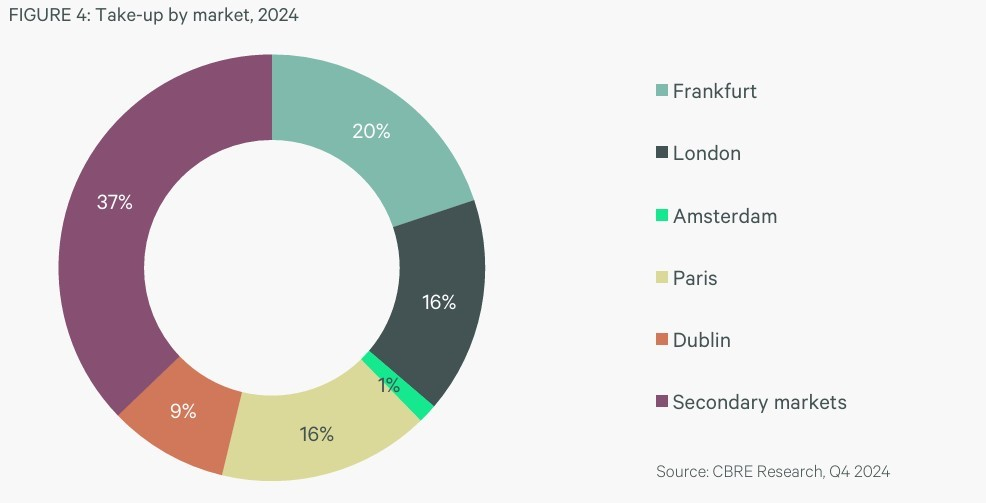

This helps explain the take-up percentages by market in the figure below – rapid growth outside FLAPD where there is more availability and where both Enterprises and providers increasingly want to be has created a combined take-up rate of 37% for the Secondary markets – which is the equivalent of combining the take-up rates of 3 out of the 5 FLAPD individual take-up rates (eg, Frankfurt, London & Amsterdam or Frankfurt, Amsterdam & Paris).

CBRE estimates that nearly 1 GW of data center capacity will be added in Europe in 2025, representing a 20% increase by year-end, and even then, the European vacancy rate will close below 10% for the first time ever in 2025.

So here’s the question: Is there anywhere that DC capacity growth is keeping up with demand?

Let us know your thoughts in the comments!