Last week, the OCOLO team summarized the Q4 and FY 2024 Europe data center market report from the outstanding Research Team at CBRE, the #1 commercial real estate services and investment firm in the world. This week, they’re out with their 2H 2024 North America Data Center Market Trends Report, containing a slew of new records set in an unprecedented year for the industry.

State of the Market

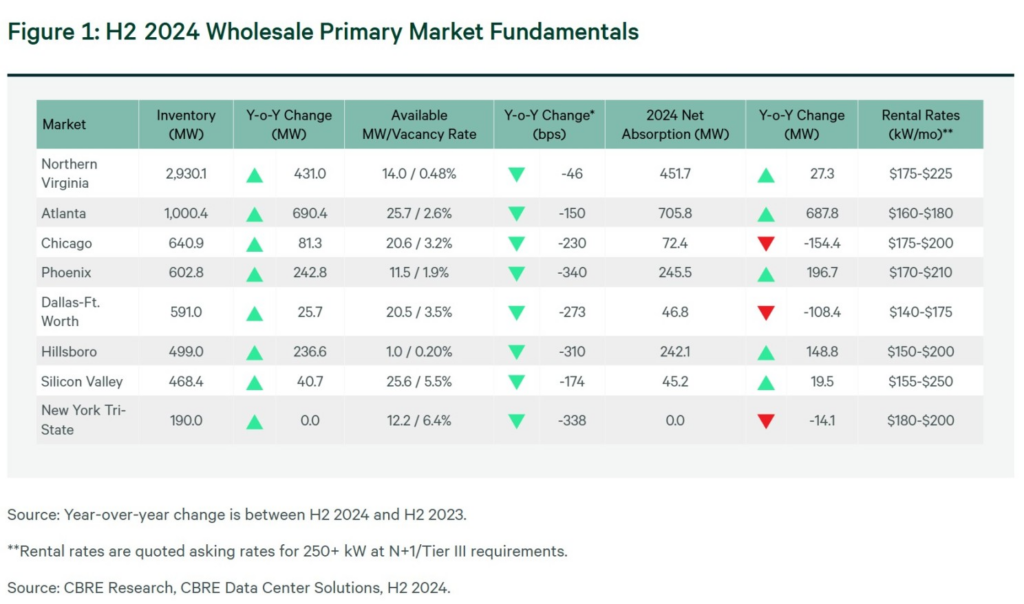

- Supply in primary data center markets increased by 34% year-over-year to 6,922.6 megawatts (MW), far surpassing the 26% increase in 2023.

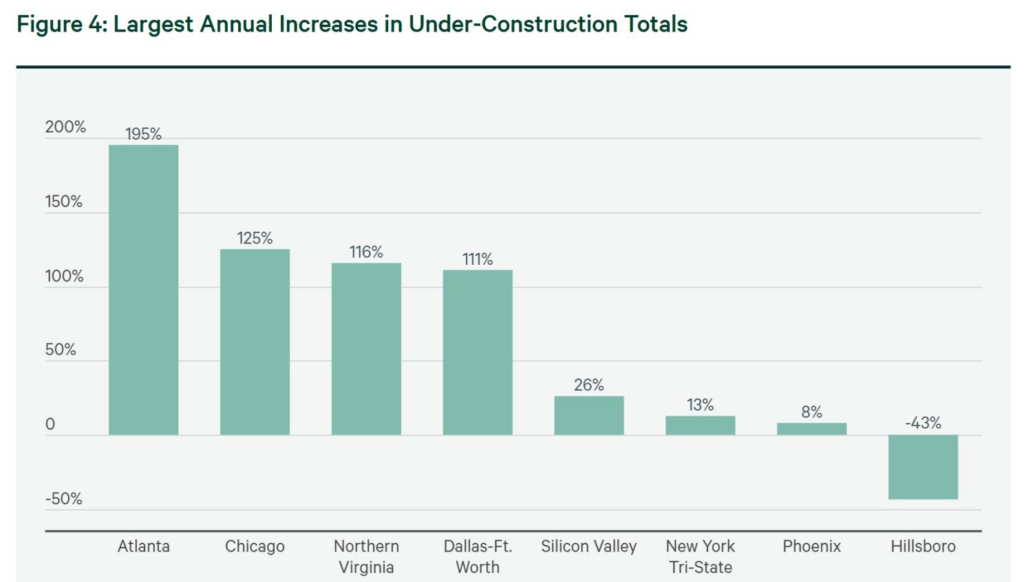

- Primary markets had a record 6,350 MW under construction at the end of 2024, more than double the 3,077.8 MW at year-end 2023. This surge was driven by robust demand and extended construction timelines due to power constraints and supply chain delays.

- The overall vacancy rate in primary markets fell to a record-low 1.9% at year-end. Only a handful of facilities with 10 MW or more are slated for delivery in 2025 and are not yet leased, reflecting the scarcity of large-scale available inventory.

- Atlanta led all primary markets for net absorption in 2024 with 705.8 MW, well above perennial leader Northern Virginia’s 451.7 MW. This was the first time any market surpassed Northern Virginia in annual net absorption.

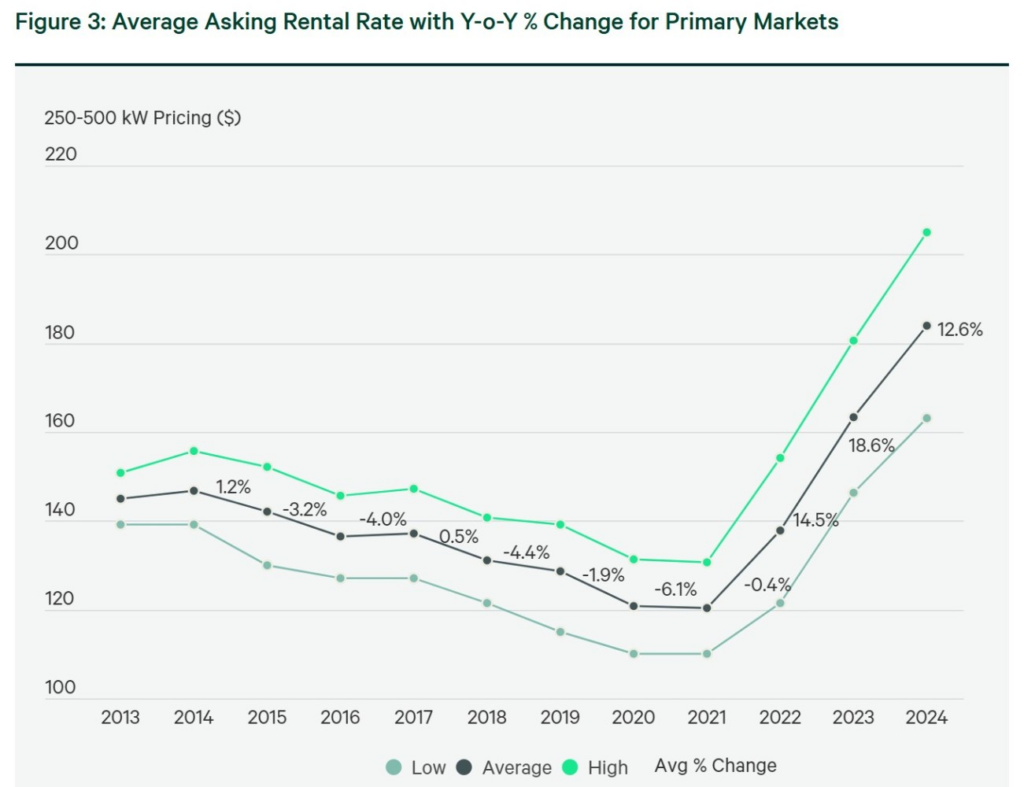

- The average monthly asking rate for a 250-to-500-kilowatt (kW) requirement across primary markets increased by 12.6% year-over-year to $184.06 per kW, reflecting continued demand amid tight supply.

- The rise of artificial intelligence (AI) workloads is transforming the data center industry, driving unprecedented demand for power-intensive infrastructure. AI-related occupiers are increasingly influencing site selection, design and operational requirements, prioritizing markets with scalable power capacity and advanced connectivity solutions.

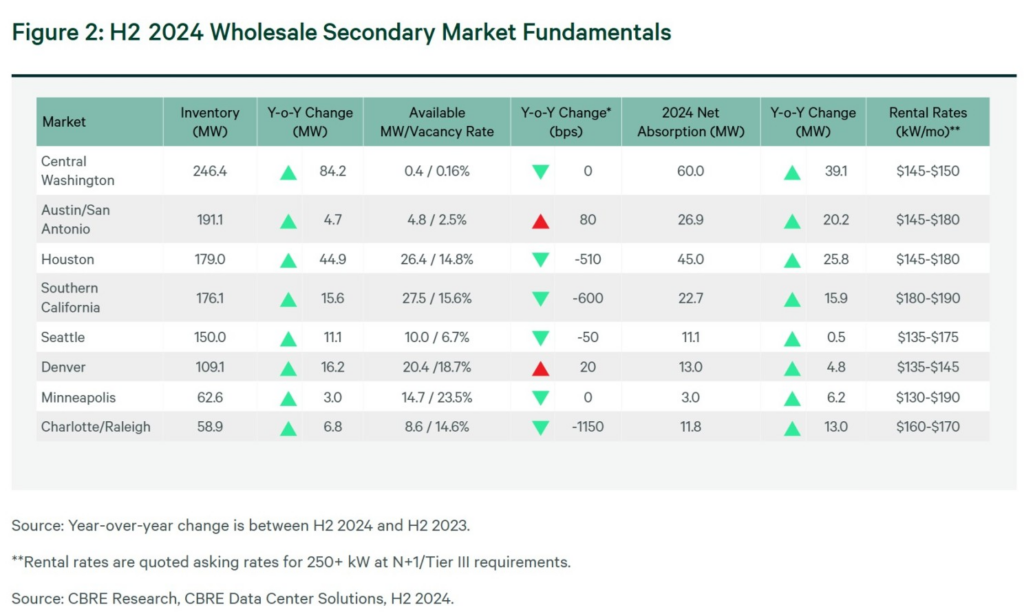

- Markets like Charlotte, Northern Louisiana and Indiana are seeing significant investment due to tax incentives, available land and greater power accessibility. These markets are poised to grow as they attract hyperscale and colocation providers alike.

Pricing

- Due to ongoing supply constraints and surging demand, the average asking rate for primary wholesale colocation markets for a 250-to-500-kW requirement increased by 12.6% year-over-year to a record $184.06 per kW/month.

- Tenants renting larger spaces have historically benefited from volume-based pricing discounts. However, with rising demand for large contiguous space, these discounts have been significantly reduced or eliminated, intensifying pricing pressures for large-scale users.

- For 3-to-10-MW requirements, Hillsboro, OR had the biggest year-over-year pricing increase of 46%. The average rate climbed to $167.50 per kW/month from $115.00, driven by heightened demand and constrained supply.

- Data center operators continued to face elevated costs due to higher construction costs, equipment pricing and persistent shortages in critical materials like generators, chillers and transformers.

- A notable pricing disparity persists between new-build data centers and legacy facilities, reflecting the premium placed on modern, energy-efficient infrastructure. Specifically, liquid/immersion cooling is preferred over air cooling for modern server requirements.

Investment Activity

- Investment activity grew exponentially in H2 2024, with a notable increase across all transaction types, including single-asset sales, core-asset recapitalizations and build-to-suit joint ventures.

- Annual sales volume exceeded $6.5 billion in 2024.

- The average sale price also increased year over year, reflecting the growing scale of data center campuses. Eleven asset sale transactions exceeded $90 million, while five surpassed $400 million.

- Supply-and-demand dynamics continued to support strong rent growth, which lowered going-in cap rates and created opportunities for non-stabilized asset acquisitions with contracts below current market rates.

- Owners and operators are increasingly seeking more power and land than ever before. Powered land transactions in the 250-to-500-MW range are the most common, with several deals exceeding this capacity.

- Sites that can offer power within the next 18 to 24 months are highly sought after. Power delivery to many sites takes much longer. While location remains an important factor, it has become less critical in site selection. Tertiary and rural markets have seen unprecedented deal activity for powered land.

- How much power demand will ultimately arise from the current growth of data centers remains uncertain. Alternative power sources, particularly nuclear, are being evaluated as potentially viable solutions to meet rising demand.

- Hyperscalers are pouring record amounts of capital into data centers, spurred by the rapid growth of AI. Increased capital expenditures are expected to create long-term opportunities and greater financial returns in 2025.

Outlook

- We expect deployment of up to $500 billion in capital for Project Stargate—a joint venture between OpenAI Oracle and SoftBank Group Corp. to build 20 large AI data centers in the U.S.—to focus on greenfield campuses that may take five years or more for completion.

- Transitioning from coal-generated to renewable-energy power generation will continue to gain traction in 2025. On-site solar, wind, geothermal and nuclear generation are all being evaluated, with natural gas being an interim alternative to coal.

- Power will remain the No. 1 priority for selection of greenfield development sites.

- While flood plains have historically been a key consideration for selection of data center development sites, we expect they will be less so in 2025 for sites with ample power availability and raised construction to avoid flood damage.

- Despite record construction activity, the data center market will struggle to keep pace with demand, leading to higher utilization rates in existing facilities and tighter vacancy rates.

- Procurement of electrical components and infrastructure will remain a key driver for expedited development construction timelines. Supply chain challenges will persist and keep large project timelines over three years.

- Demand from large occupiers requiring 10-to-30-MW of continuous space is expected to sustain a rental-rate premium, outpacing pricing for smaller-scale requirements in the 1-to-5-MW range. This marks a significant shift from the historical trend of pricing discounts for larger requirements.

- The growth in network demand driven by digital services, cloud computing, AI and 5G is also driving a persistent surge in demand for data center capacity. Applications on cell phones, smart devices, laptops and desktops are using large amounts of data for processing, storing and computing data.

- Natural gas on-site generation solutions will assist local utilities in peak-load periods, while also providing redundancy to the traditional grid. A potluck-type of approach to bring power to the utility for developers can be a differentiator with utility interconnection.

- Occupiers will continue to prelease space three to five years ahead of completion for large requirements.

- High-voltage transmission projects will be required for data center development and will be challenged by permitting, planning and zoning regulations, as well as workforce availability and supply chain disruptions.

So, clearly the data center growth story continues at its record setting pace in its largest global market, setting the stage for another record year. Yet again, the evolution of AI will drive both demand and growth in data center development, as it will across most aspects of digital infrastructure. CBRE has given us a lot to think about and track as we look ahead nearly one-quarter into 2025.