The smart folks from the CBRE Intelligent Investment Research Team are out with their North America Data Center Trends H1 2024 report this week summarizing the state of the market, and providing yet more proof that Cloud and AI providers are driving continued strong demand. Here are the key summary points and exhibits they shared.

State of the Market

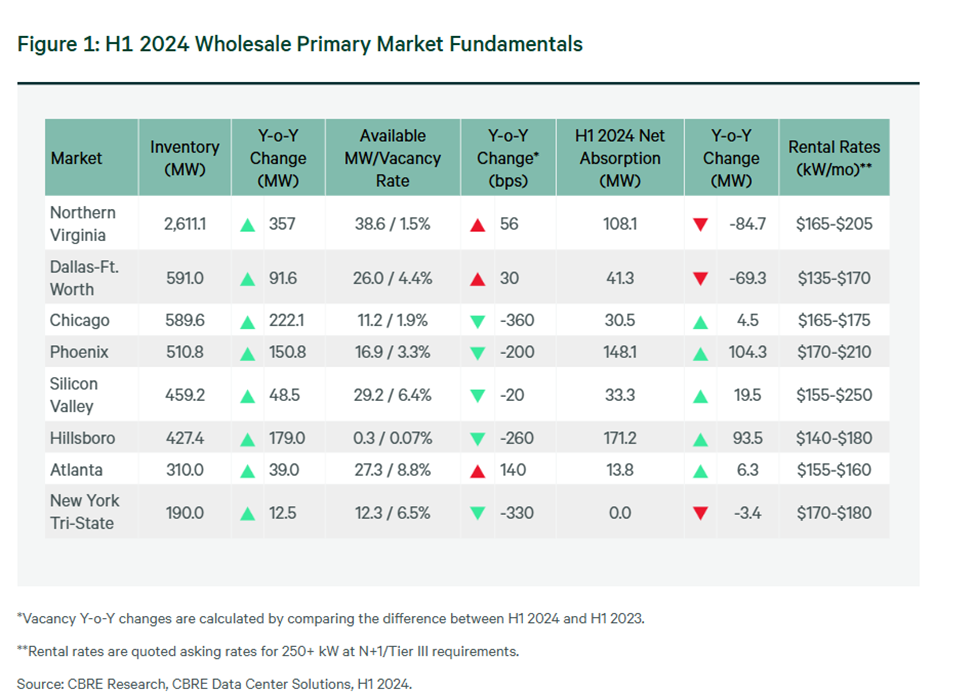

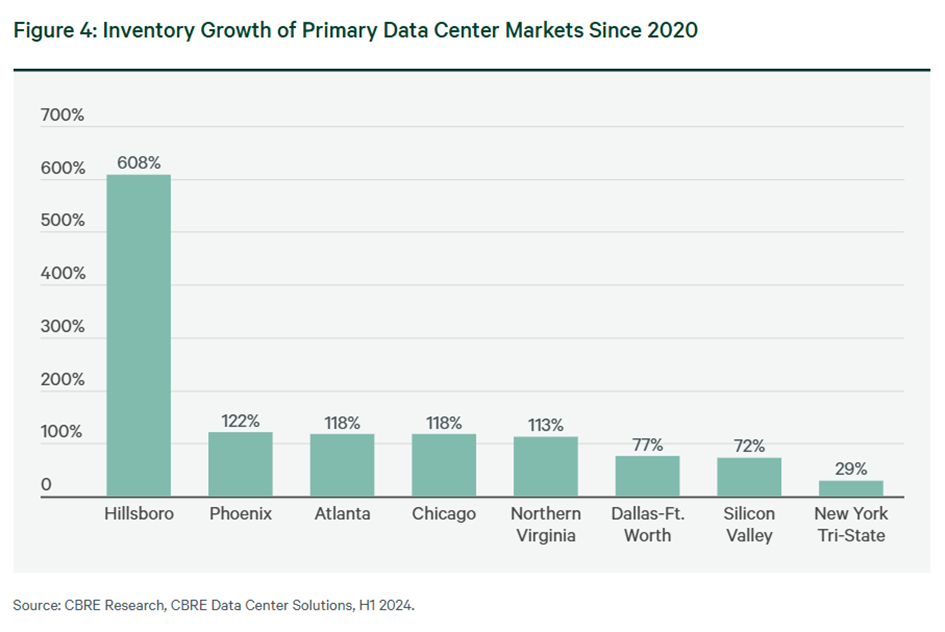

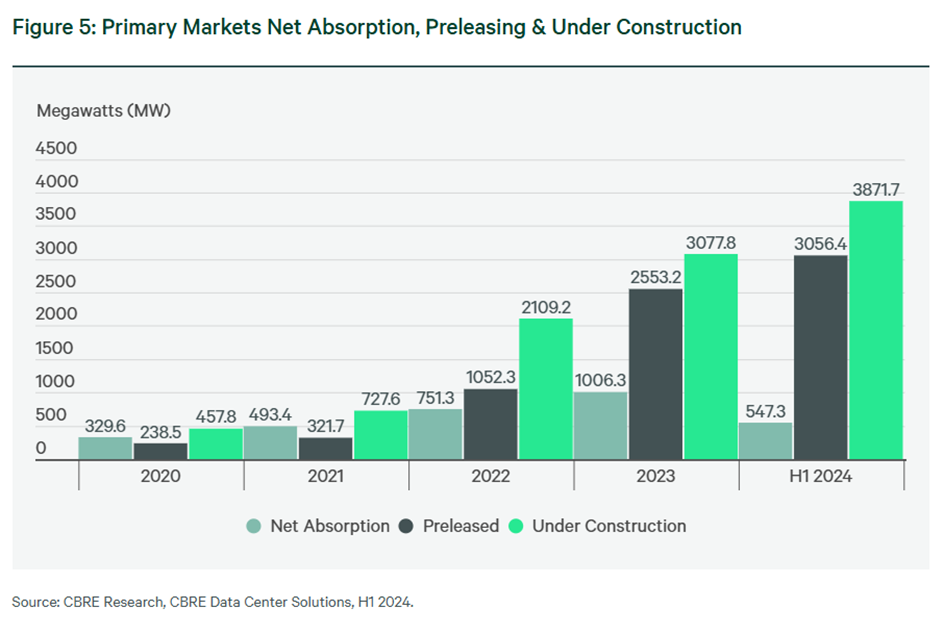

- Supply in primary markets increased by 10% or 515.0 megawatts (MW) sequentially in H1 2024 and by 24% or 1,100.5 MW year-over-year.

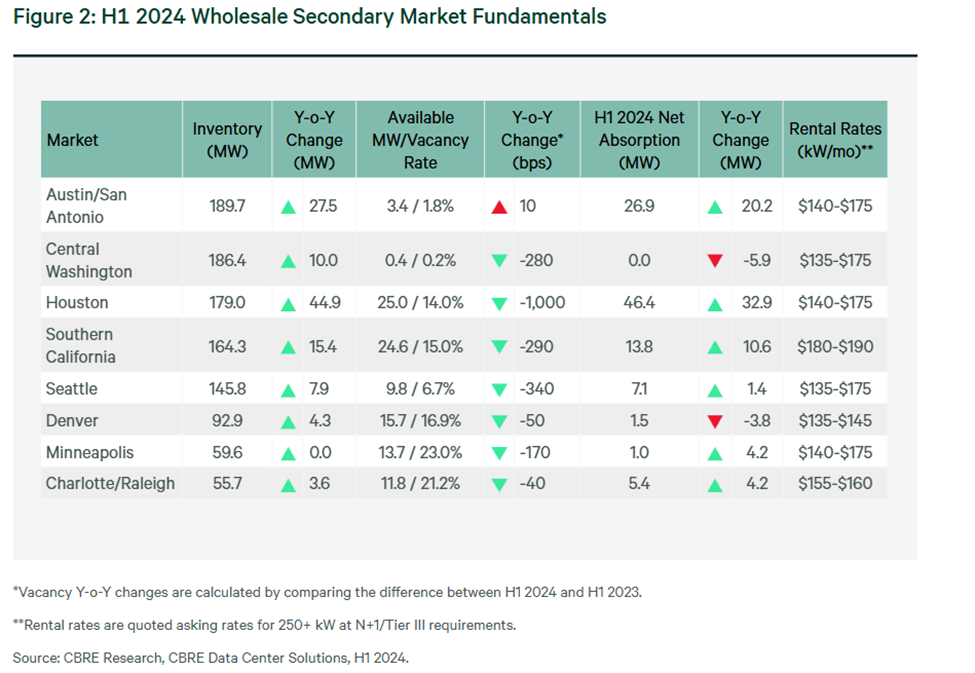

- The overall vacancy rate for primary markets fell to a record-low 2.8% in H1 2024 from 3.3% a year earlier, while the overall vacancy rate for secondary markets fell to 9.7% from 12.7% over the past year.

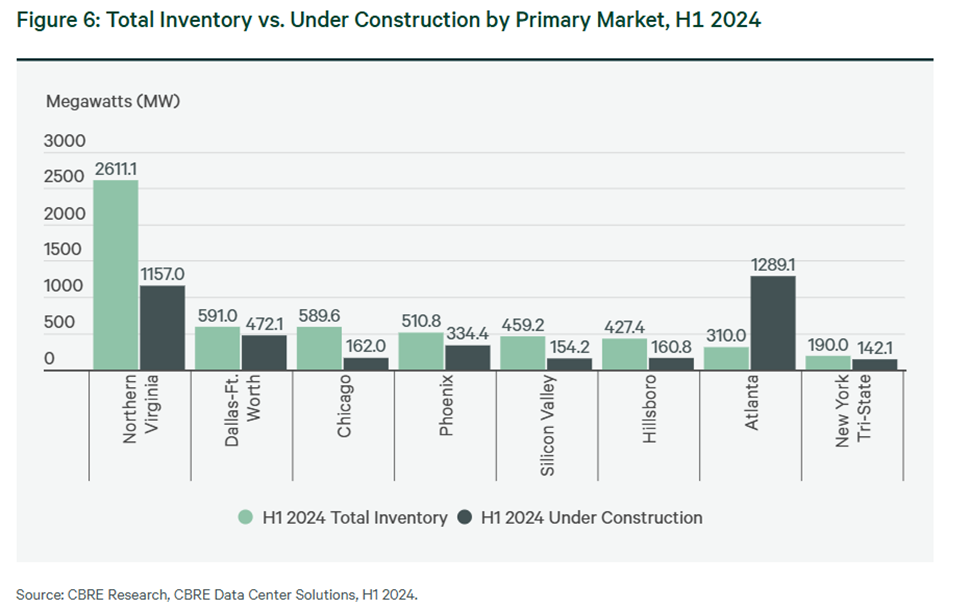

- Under-construction activity in primary markets hit a record-high 3,871.8 MW, up by 69% from a year earlier. However, a shortage of available power and longer lead times for electrical infrastructure continued to delay construction completions.

- Atlanta under-construction activity increased by 76% year-over-year to 1,289.1 MW.

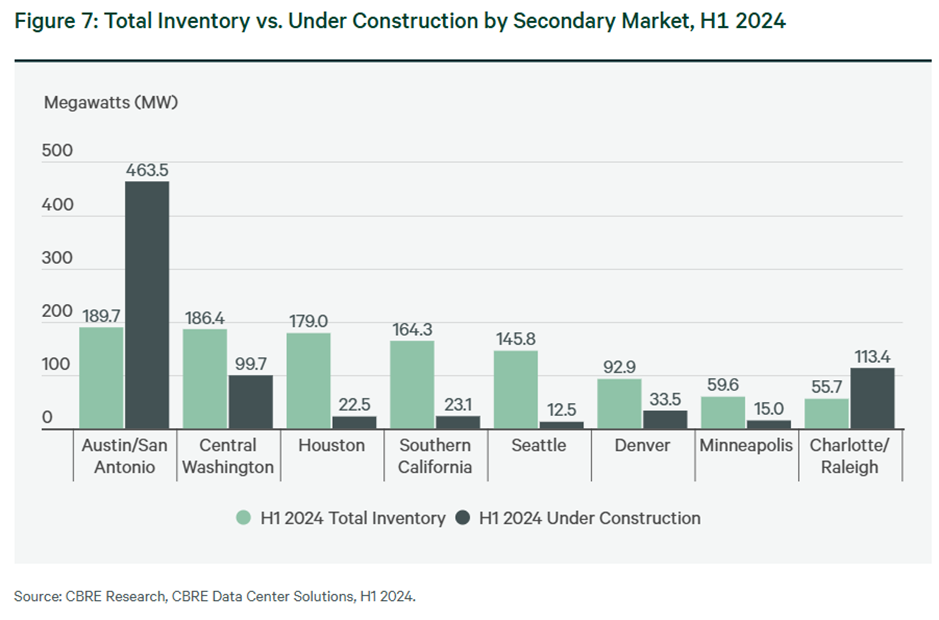

- Austin and San Antonio’s combined under-construction activity more than quadrupled from a year ago to 463.5 MW.

- Nearly 80% or 3,056.4 of the 3,871.8 MW under construction in primary markets was preleased. While cloud providers continued to lease most available power capacity, artificial intelligence (AI) providers also accounted for a considerable amount of demand.

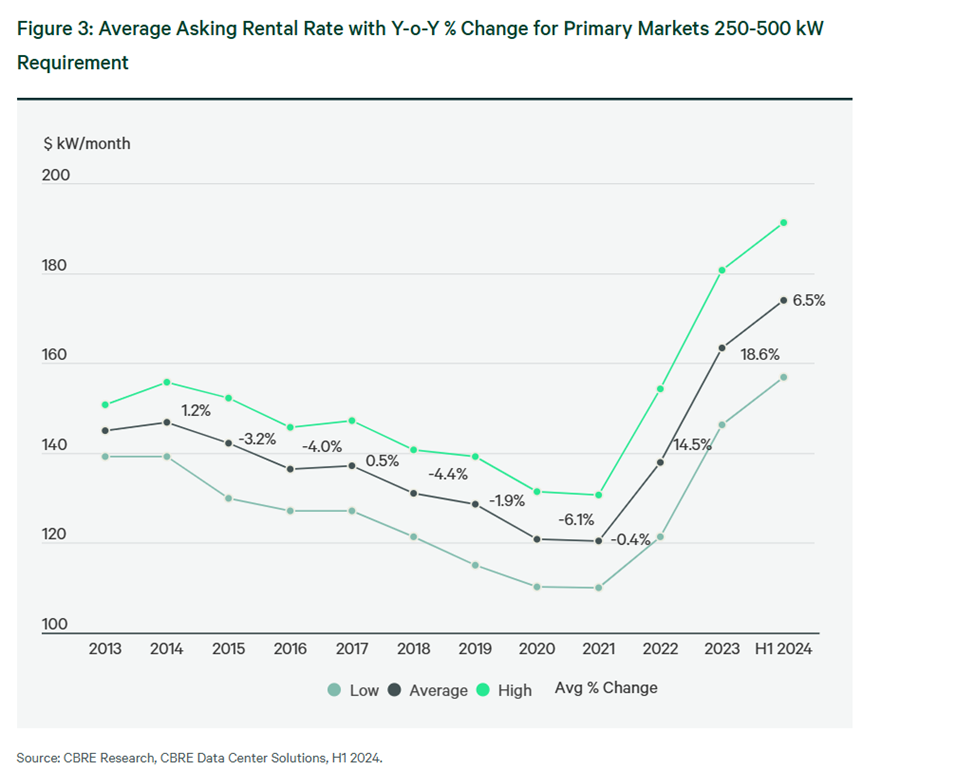

- Pricing continued to increase, albeit at a slower rate than last year. The average monthly asking rate for a 250- to 500-kilowatt (kW) requirement across primary markets increased by 7% in H1 2024 to $174.06 per kW/month.

- Power availability remained the top consideration in data center site selection

Market fundamentals for both Primary and Secondary Wholesale Markets were a sea of green:

National Lease Pricing

- Fueled by limited supply and strong demand, the average asking price across primary wholesale colocation markets for a 250- to 500-kW requirement increased by 6.5% in H1 2024 to $174.06 per kW/month.

- Atlanta led all primary markets with a 26% year-over-year increase in pricing, largely due to strong demand from AI providers.

- Rental rates are expected to increase further in H2 2024 due to rising construction and equipment costs.

- Increased demand for high-power computing is creating a significant price disparity between new data centers and legacy facilities. Many existing data centers lack the infrastructure to handle these demanding workloads, further limiting their appeal.

Capital Markets Insights

- Investment activity was largely centered around new development, as strong tenant demand, rental-rate growth and higher yields continued to fuel a landlord-favorable market.

- Many potential sellers remained on the sidelines, anticipating that lower and more stable interest rates will eventually lead to lower capitalization rates.

- The bid/ask spread between sellers and buyers tightened due to expectations of lower interest rates later this year.

- CBRE expects increased investment volume and sales transactions in H2 2024.

- Digital Realty accounted for most of the investment activity in H1 2024. Cyxtera Technologies’ bankruptcy accounted for several other sales transactions.

Notable H1 2024 Investment Activity

- Amazon Web Services (AWS) closed on the first phase of its $650 million acquisition of Talen Energy‘s nuclear-powered data center campus in Pennsylvania.

- PGIM and Equinix announced their $600 million joint venture development of a new Silicon Valley data center.

- Several notable transactions were either initiated or completed by Digital Realty : The first phase of a $7 billion joint venture with Blackstone was completed on campuses in Paris, France and Northern Virginia. The joint venture also will include development of hyperscale data centers in Frankfurt, Germany. A $400 million joint venture with Mitsubishi Corporation was announced for development of two 100% preleased data centers in Dallas. A 75% interest in a Chicago data center was secured from GI Partners for $385 million. A $271 million sale of Digital Realty’s interest in four data centers to Brookfield Infrastructure Partners L.P. was completed in relation to Cyxtera Technologies’ bankruptcy.

Valuation Insights

- Supply-and-demand dynamics continued to support strong rent growth, which is lowering going-in cap rates and creating opportunities for non-stabilized asset acquisitions with contracts below current market rates. Although the high cost of capital continued to apply upward pressure on cap rates and rates of return, demand for powered land remained strong.

- Determining value for sites that are suitable for data center development has never been more challenging due to the physical, legal and timing aspects of various powered land opportunities. This involves an evaluation of the grid infrastructure to determine how much power will reach the site and by when. The dearth of suitable sites has led to bidding wars for the few that meet certain power and fiber requirements.

- Construction lending activity remained strong, especially for preleased and stabilized assets on track to meet promised lease commencement dates.

- Many of the largest hyperscalers’ new developments will become operational over the next few years, with AI requirements driving further demand. This demand increased throughout H1, leading to significant debt financing by data center providers such as CoreWeave , Aligned and EdgeCore Digital Infrastructure to fund new development.

Network Insights

- Fiber network growth is expected to continue following hyperscale development in tertiary markets. For example, Mt. Pleasant, WI, Boise, ID and Cheyenne, WY have all seen hyperscale development in recent years, followed by active or planned network deployments. Networks that emerge due to hyperscale presence are typically purpose-built, long-haul or medium-haul and are deployed underground.

- Electric cooperatives, covering 56% of U.S. landmass, are accelerating their expansion into the broadband market as part of a broader strategy to enhance internet access and improve grid management. As of March 2024, more than 25% of U.S. electric co-ops have deployed broadband services by leveraging existing infrastructure, right-of-way and government grants and subsidies. For example, First Electric Cooperative Corporation has more than 4,300 miles of fiber deployed across 18 counties, while EPB in Chattanooga has speeds up to 25 gigabits available for anyone on the network. Many more co-ops are expected to launch broadband and fiber deployment initiatives in the next few years.

- Major fiber providers continued to expand their networks to connect more locations. Regional and specialty fiber providers also expanded their network footprints, including Zayo Group, Windstream, FiberLight, LLC, Arcadian Infracom, Segra and Conterra Networks deploying thousands of miles of middle-mile, regional and purpose-built networks.

Data Center Outlook

- Adoption and utilization of digital applications will continue to drive data center demand due to more storage, computing and processing of data.

- Power delivery timelines will continue to increase in H2 2024 due to a shortage of readily available equipment, such as transformers, switches and generators. Difficulty in procuring critical equipment will lead to power delivery delays of up to four years.

- Markets such as Northern Indiana, Idaho, Arkansas and Kansas will continue to draw interest from hyperscalers and developers due to land availability and power availability timelines.

- Occupiers will be forced to prelease space between two and four years ahead of completion to meet their future data center requirements.

- We expect increased adoption of fixed wireless and fiber-to-the-home solutions to help provide high-speed connectivity across the U.S.

- The federal funds rate is expected to decrease slightly in H2 2024, which may loosen lending conditions.

Trends to Watch

- The rise of AI and machine learning is driving significant changes in data centers, including increased use of graphics processing units (GPUs) and liquid cooling to reduce the heat from these more power-intensive applications.

- With carbon emission goals for 2030 rapidly approaching, will improvements in cooling efficiency, recycling waste heat and renewable energy power generation sources become imperative for operators in H2 2024?

- Will mainstream adoption of new applications requiring edge computing occur in H2 2024?

- Will an unexpected event disrupt capital expenditures to improve utility transmission and distribution across the country?

- Semiconductor chips and graphics processor companies continue to grow top-line revenue at an impressive rate. Will hyperscaler capital expenditures continue to grow in tandem with GPU production?

- Will historically low natural gas prices over the past year rise in H2 2024?

- Has public perception of nuclear power improved enough that small modular reactors can be used to power data centers?

The Outlook and Trends sections outlined above are particularly interesting to the OCOLO team because they echo what our CEO, Tony Rossabi is hearing in his global travels this summer to attend and speak at various industry conferences, attend company and Board meetings and meet with potential OCOLO-listed service providers and IT professionals and enterprises interested in using our revolutionary new search-to-order, end-to-end digital platform for colocation transaction services.

With each new data point we collect that suggsts an extended trajectory upward and to the right for data centers, our excitement builds about what OCOLO can do to make colocation transactions more transparent, efficient and cost effective for everyone involved.

Many thanks to the CBRE Intelligent Investment Research Team for putting together this comprehensive and insightful overview of first-half trends in the data center solutions space, with particular credit going to the authors of the report: Patrick Lynch, Executive Managing Director, Gordon Dolven, Director of Americas Data Center Research and Josh Ruttner, Associate Research Director.

Those of us on the OCOLO team with backgrounds in economic, industry/sector and equity research know the tedious effort that goes into analyzing quarterly earnings releases, 8Ks/10Qs and other documents for the apples-apples disclosure ncecessary to create these seemingly straightforward charts and graphs. While ChatGPT has recently simplified life in the research trenches, it hasn’t taken on the whole load, so we appreciate the ongoing efforts these professionals make to break down the numbers for us!