The OCOLO team is thrilled to have access to Citi‘s CitiVelocity research portal, where Citi‘s brilliant research and strategy team share their insights on global debt, equities, industries, sectors, markets, and economic trends with institutional clients.

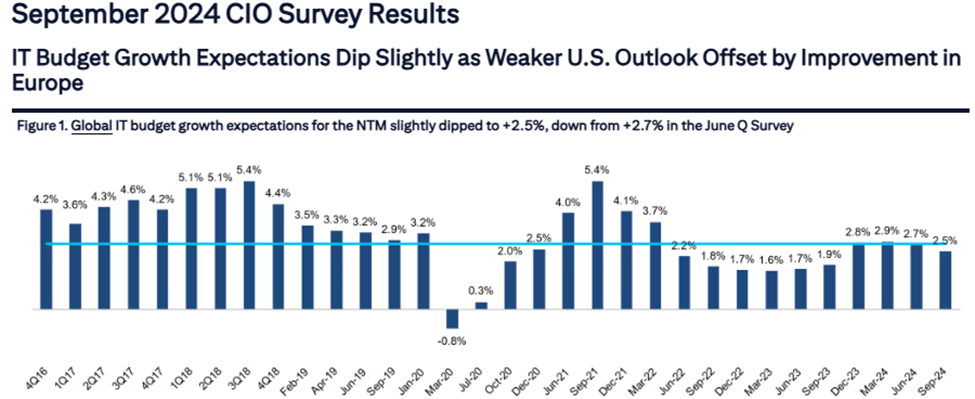

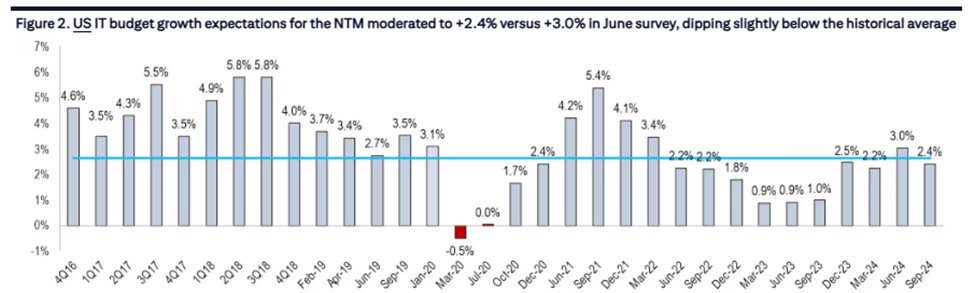

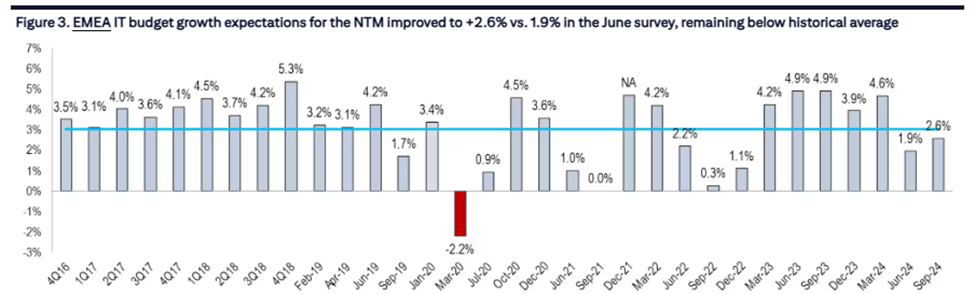

One of their many invaluable tools is a quarterly CIO Survey conducted by Citi’s Global Technology & Communications Team assessing companies’ plans for overall IT spending over the next twelve months (NTM), and providing takeaways by sector for the Software, European Technology, Internet, Hardware, Communication Services and Infrastructure and IT Services sectors.

Key takeaways for Q324:

Mixed Bag of Global IT Spend

Slight deterioration in overall IT budget environment, with US NTM spending growth expectations down from 3.0% at end-Q224 to 2.4% at end-Q324, reducing global IT budget growth from 2.7% to 2.5% for the same periods. At the same time, Europe improved from 1.9% growth to 2.6% growth.

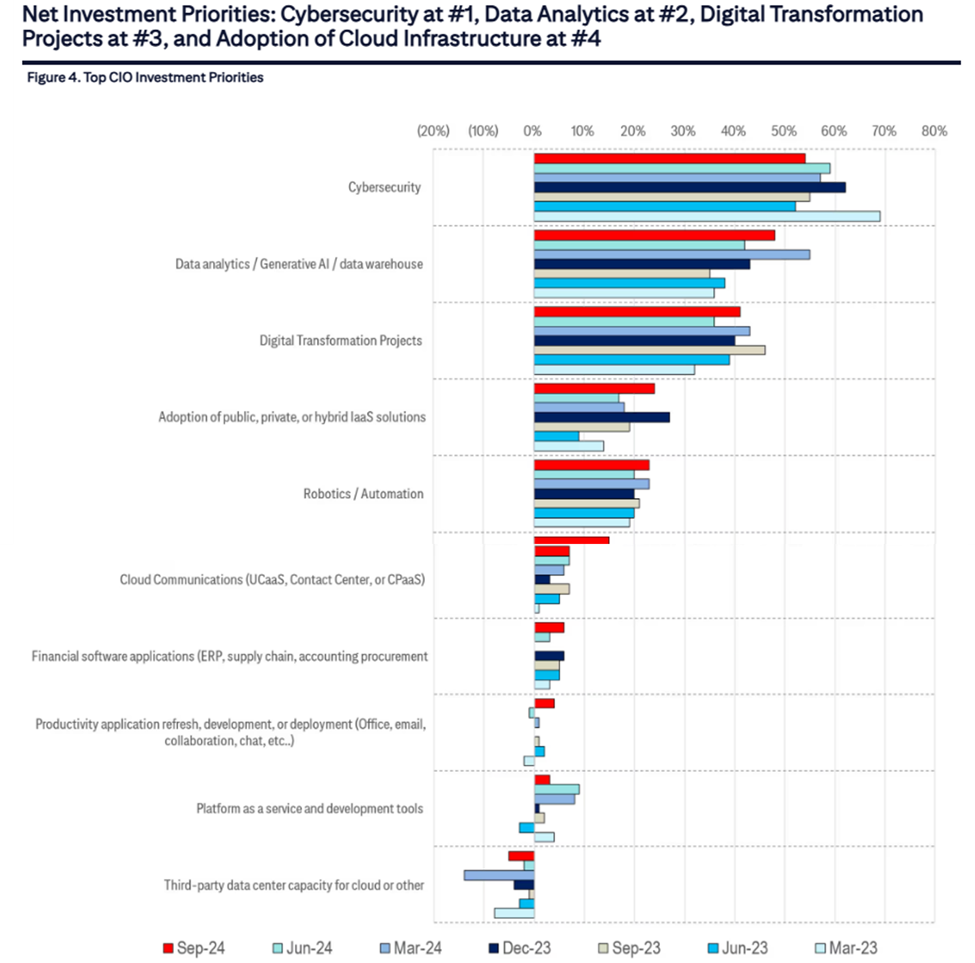

Cybersecurity Holds On To #1 Spot

Cybersecurity remains CIOs’ top investment priority, although data analytics/GenAI is gaining mindshare. Cyber also tops the list for spend consolidation despite the July 19th IT outage, good news for platform vendors. Network Security gained in investment priority rankings in Q324, while Cloud continues to be top of mind and VM sentiment generally improves. Data Analytics/Gen AI and DX projects remained the second- and third-highest priorities. Adoption of Cloud Infrastructure overtook Robotics/Automation as the #4 net investment priority, the first time since December 2023.

Generative AI Gobbles Up the Pie

Generative AI remains a top priority for IT spend among CIOs: 77% of CIOs expect to get new/additional funding for Gen AI projects in the NTM, up from 71% last quarter. The winner in the GenAI arms race remains Microsoft by a wide margin, with OpenAI, Amazon and Google in distant second, third and fourth place.

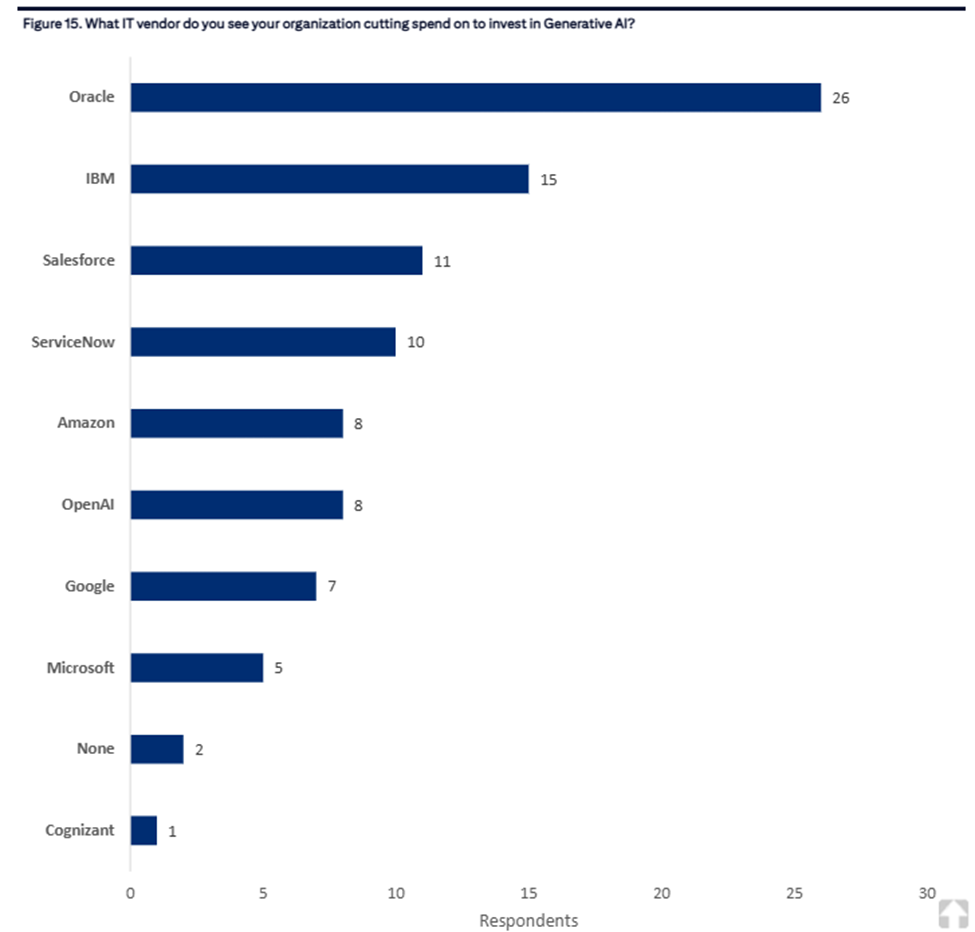

The big losers: Oracle, IBM, Salesforce and ServiceNow – the IT vendors where CIOs say they’ll cut back to invest more in GenAI.

ther categories of IT spend will take a hit to fund GenAI as well in the NTM, according to CIOs surveyed, namely PCs, consulting, back and front office projects and traditional business intelligence/data warehousing services.

CIOs are confident they can “spend smartly” going forward by judiciously reducing spend on lower-priority IT initiatives while allocating more to GenAI and other high-priority areas. They expect this calibrated approach will ultimately reduce both overall IT budgets and headcount down the road.

- Nearly two-thirds of respondents reported no negative impact on other traditional IT budgets because of increased AI and GenAI spend,

- 75% responded “No change” or “Modestly increase” to the question of the impact GenAI will have on their Hardware Budget,

- Respondents were about evenly split on NTM spending on PC refresh/upgrades, data center compute/storage and network infrastructure, with 52% predicting 0-25% growth and 48% weighing in with 0-25% declines, mostly clustered in the 0-10% range in both directions.

- Meanwhile, 61% of respondents expected network infrastructure spending to grow between 0-25% over the NTM, down slightly from the 67% who fell into these combined categories for the last twelve months (LTM), with the vast majority falling in the 0-10% range.

As for expectations on pace for recognizing headcount reductions, responses are likely skewed by how far along they are in the process (eg, test case vs. production), but 3% of survey respondents estimate they’ll start to see results in the next 6 months, while 76% have set a 1-2 year time frame and 21% estimate 2+ years.

Seeing these survey results on a quarterly basis allows us to track how CIOs are gaining confidence in their ability to calibrate, quantify and anticipate overall IT spend – and GenAI spend in particular – over the long term. It also gives us a sense of who’s best positioned in the AI Arms Race, and who may be slipping behind. In the digital infrastructure space, where each day brings new examples of both innovation and obsolescence in equal parts, that’s invaluable insight.

Again, many thanks to the Citi Global Technology & Communications Research Team and the many contributors to the Q324 Citi CIO Survey Tyler Radke, Fatima Boolani, Steve Enders, CFA, Michael R.(Michael Rollins, CFA), Balajee Tirupati, CFA Asiya Merchant, CFA, Ron Josey, Ryan Potter, Atif Malik, Pavan Daswani, Peter Griffith, Ashley Kim, George Kurosawa, CFA, Joel Omino, Yitchuin YC Wong, Mark Chang, Kylie Towbin, Roberta Versiani, Matt Pryde, Amanda Nastevski, Michael Cadiz, Adrienne Colby, Papa Talla Sylla and Daniel Schafei.