The Chicago-based global real estate services firm JLL, which operates in the office, industrial, retail multifamily and data center sectors across more than 80 countries, is out with their 2025 Global Data Center Outlook, with optimistic growth estimates for the sector that aren’t likely to surprise anyone.

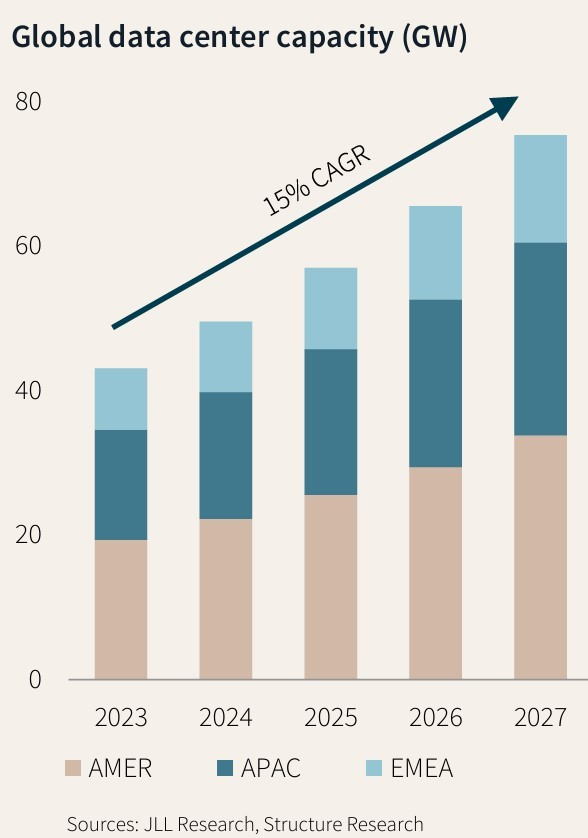

Based on developments currently under construction and planned, they’re predicting data center market CAGR of anywhere from 15-20% through 2027, with the variance between baseline and upside potential driven by four key factors: 1) Artificial Intelligence (AI); 2) Power grids; 3) Liquid cooling; and 4) Capital markets. Let’s delve into their findings on each.

Artificial Intelligence

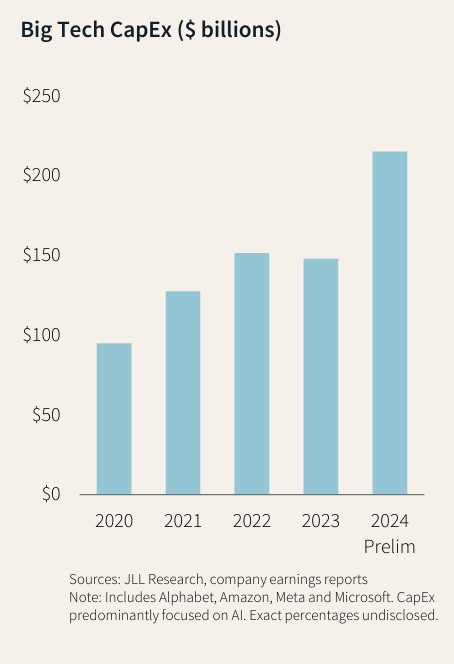

According to the study, with billions invested over the last couple of years and even more earmarked for the years ahead, AI data center demand will continue to accelerate going forward.

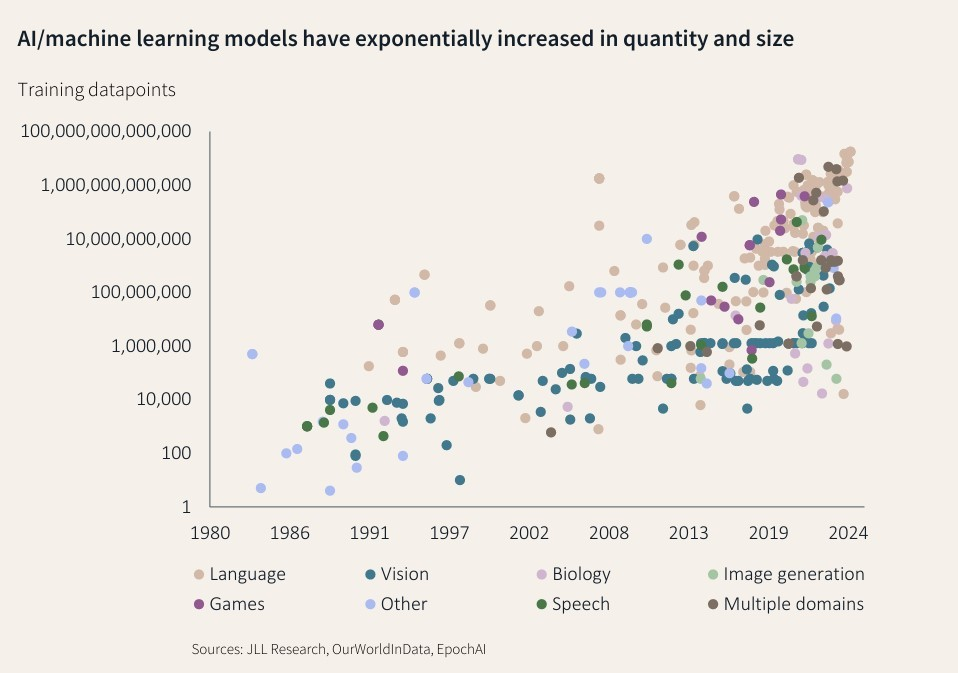

AI workloads require more powerful and efficient data center infrastructure, and advancement in semiconductor technology that the JLL report describes as driving “a race toward miniaturization that outpaces even Moore’s Law,” meaning GPUs must become smaller and more powerful in order to be consumed in smaller facilities.

This is driving GPU innovation at a dizzying pace. For example: NVIDIA’s current chips are based on 7nm technology with 208 billion transistors and rack density of 41kW. Their next generation chips under development utilize 5 nm technology with an expected rack density of 130 kw, and plans are already underway for 2 nm chips projected to reach 250 kW per rack.

Like a domino effect, rapid advancement of GPU technology drives much faster training of large language models (LLMs). The report cites that a computation task that used to take 32 hours to perform can now be completed in just one second with the latest GPU technology.

The greater power demands for AI training facilities also make them more valuable to companies eager to move from the training to inference phase with AI. According to the report, new AI training projects require 1 gigawatt (GW) or more to implement, which is the same as powering 800,000 US homes for a year.

Power Grids

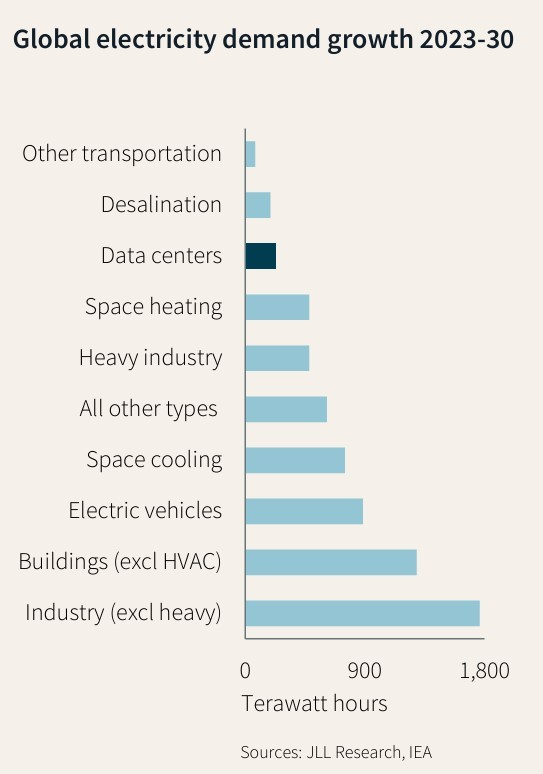

Interestingly, the report asserts that data centers will represent a relatively small component of global electricity demand growth in 2025. In fact, it cites the International Energy Agency (IEA)‘s 4% growth rate – the highest in 20 years (excluding post GFC and Covid rebounds) as being driven by several factors, including strong economic activity, increased use of air conditioning amid rising temperatures and increasing adoption of technologies like electric vehicles (EVs) and heat pumps.

Yes, data centers have been growing rapidly and consume large quantities of power, but they are still only forecast to consume 2% of the world’s electricity in 2025, and the increase in data center demand through 2030 is projected to be less than a third of the increased electricity needed for both EVs and air conditioning according to the report.

The truth is data centers are just one component of what the report calls “a complex global power dilemma” that includes increasing adoption of EVs, the electrification of machinery, rising power consumption of developing countries and a host of other challenges that accompany a giant world composed of different countries at vastly different levels of development in vastly different physical and political environments evolving at vastly different rates.

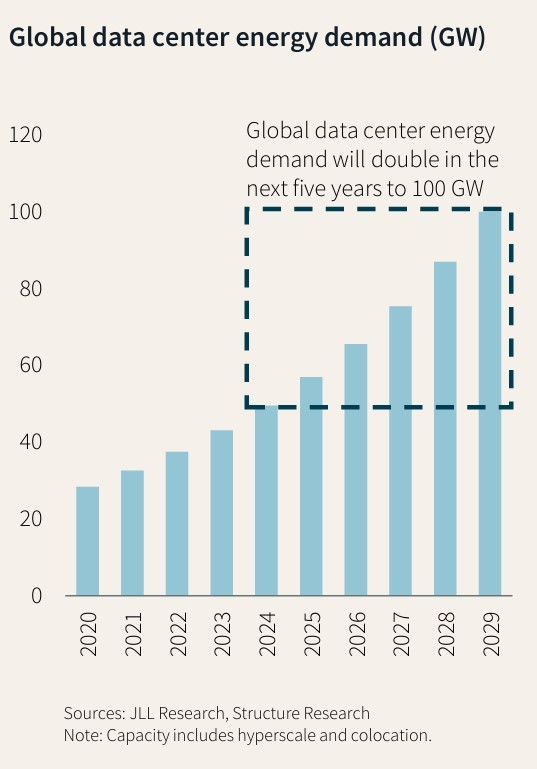

Still, it would be hard to convince players in the digital infrastructure world that capacity constraints are not a very real issue. The report acknowledges these power delivery bottlenecks and attributes them to what they call a “clustering phenomenon.” Historically, data centers have “clustered” near metropolitan areas where they can access land, water and power with proximate connectivity for customers. This has resulted in uneven distribution around the globe, but especially in the US, the largest data center market in the world. Data centers in Singapore, a hub in Southeast Asia, as accounting for around 7% of total electricity consumption. Ireland’s account for 21%. Here in the US, Virginia is the largest data center hub in the country and world and represents 26% of the state’s power consumption. The report also cites forecasts that estimate global data center energy demand will double in the next five years to 100 GW.

AI, which is more location-agnostic, is helping to break up the clusters, but it is much more power intensive. This brings new challenges – the need for space for larger facilities, the longer build-times required, inevitable supply-chain issues, power constraints requiring innovative thinking about alternative energy sources.

Enter – or rather, re-enter nuclear. Over the past several years, nuclear power has been re-emerging as a solution to meet the growing energy demands of data centers, particularly for AI and high-performance computing (HPC) applications. Tech companies, who are the largest data center tenants and the most aggressive on zero-carbon targets, are leading the charge.

The report points to multiple Purchase Power Agreements (PPAs) signed in 2024 for both active and decommissioned nuclear plants, and interest is growing in small modular reactors (SMRs), a lower-cost, scalable option that can provide 1.5-300 MW of power. While it’s still early days for SMRs – commercial deployment in the US is not expected until at least 2030, according to the report – this technology could emerge as the most accessible and credible green energy alternative for data centers long-term. The report cites the OECD Nuclear Energy Agency (NEA) and the World Nuclear Association (WNA) statistic that more than 100 sites are being evaluated for SMR installations worldwide.

This emerging trend is likely to have significant implications for site selection, data center design and ongoing operations, according to the report, and it cites SMR developers like Oklo Inc, Kairos Power, X-energy and Holtec International as early entrants in the competitive set, soon to be joined by many others as the technology evolves.

Like everything new and experimental (and given the lingering negative connotation to all things “nuclear”), developing and implementing SMRs at scale will bring its fair share of challenges, including regulatory hurdles, high initial costs, logistic issues (eg, where and how to deploy) and public perception issues. It’s probably safe to assume that SMR installations in large metropolitan areas aren’t happening anytime soon. But look for implementation of this important alternative energy source in rural areas as soon as practicable.

Liquid Cooling

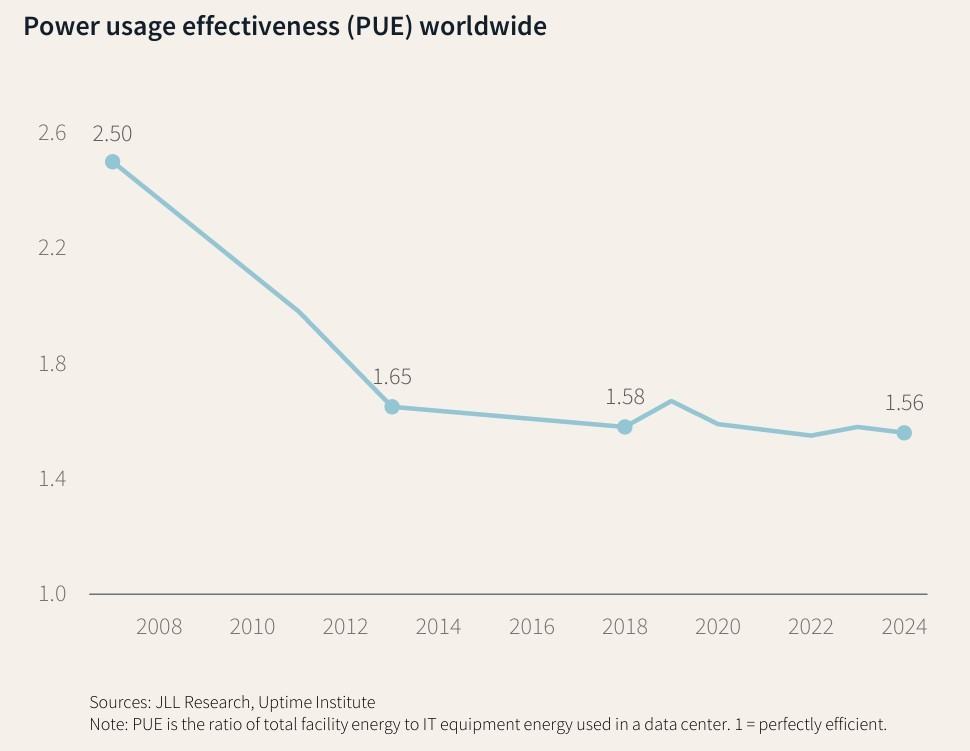

Speaking of important alternatives, liquid cooling has emerged over the past several years as a critical alternative to air cooling techniques, again as a result of the rise of AI and the greater heat that higher-powered AI workloads generate. The exhibit below shows just how much stress AI workloads have put on power grids worldwide.

As the report states: “The AI revolution is undoubtedly changing the world, but AI’s energy footprint may be its most profound and lasting impact. New PUE (power usage effectiveness) regulations and greater rack densities will drive the industry towards liquid cooling, as it is nearly impossible to achieve low PUE values with traditional air cooling alone.”

According to the report, at this point, liquid cooling has become mandatory for AI workloads. NVIDIA’s latest AI chips consume up to 300% more power than their predecessors, and industry forecasts suggest that global data center energy demand will double in the next five years.

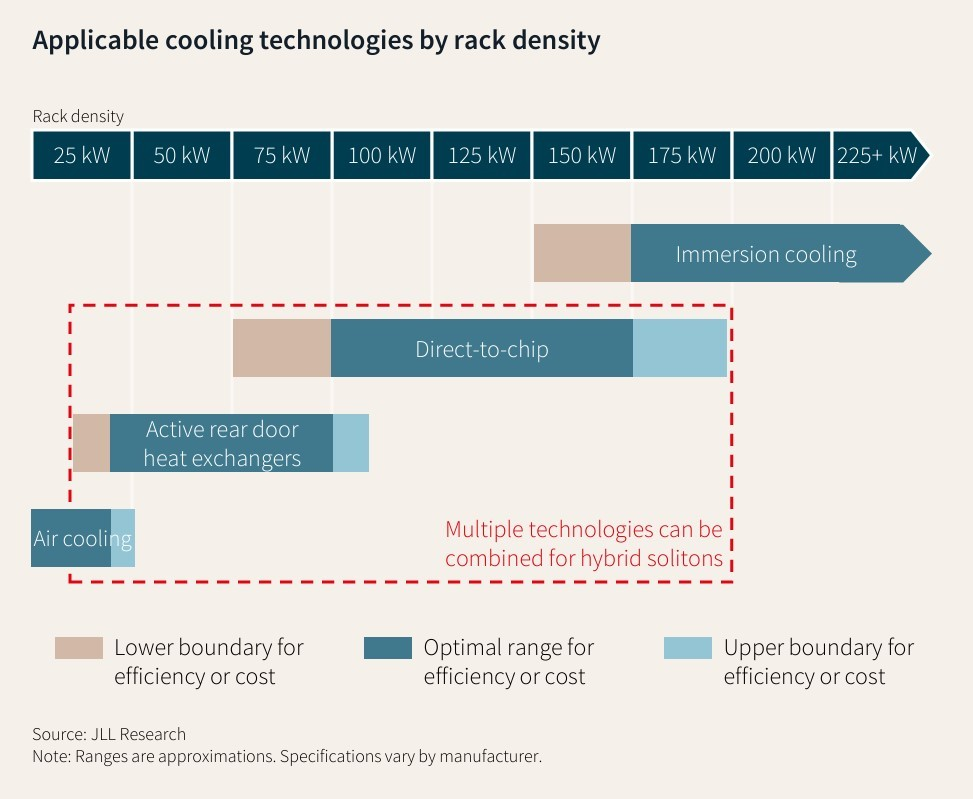

From the current 70% liquid/30% air cooling hybrid approach typically employed with high-density racks today, data centers determined to be AI-ready will have to install 100% liquid cooling systems in the form of rear door heat exchangers (RDHx) and direct-to-chip (DTC) technologies. In fact, the report says that liquid cooling infrastructure has quickly become the default installation in new data center construction and RDHx and DTC retrofits are table stakes for existing facilities looking to take on higher-density workloads.

Of course, like everything else in the world of digital infrastructure, data center cooling technology is constantly innovating and evolving as well. The next iteration of thermal management that is already underway is immersion cooling, targeted at GPUs above 150 kW per rack. According to the report, the global average rack density is currently only 12 kW and immersion cooling is implemented in less than 10% of data centers today. And of course, the benefits of highly efficient cooling must be weighed against the structural design challenges caused by the weight implications of the new cooling baths, which require significantly reinforced flooring. Watch this space…

Capital Markets

The report points out that data centers retain a high barrier to entry for investors given their highly technical and capital-intensive nature. Long-time followers of the space know that gaining exposure to the sector usually requires finding a way to participate in development financing through real estate firms like JLL or private equity firms. The report suggests that equity placements in land development and ground-up construction will remain the primary path to exposure in 2025. It also points out that the data center sector has experienced a “deluge of M&A activity” between 2020 and 2024 of more than $200 billion. Preliminary 2024 estimates show about half of the year’s deals were valued at $2 billion or more. The report estimates that M&A will slow in 2025 as this activity is absorbed, and there will be smaller, more bolt-on acquisitions given how much data center valuations have appreciated.

The report also talks about how few data centers trade annually. As the below chart illustrates, data center sales have averaged just $7 billion in value annually since 2020, compared to an annual average of $241 billion for office buildings.

Most likely, owners holding on to data centers have advantageous financing and are able to secure strong leasing terms in the current environment of strong demand, so have no need to sell.

Conclusion

To sum up, for well-positioned and well-maintained data centers, particularly those able to retrofit to meet demand for AI workloads, the outlook is quite positive for data centers broadly, and the JLL report does an effective job laying out the reasons why.

As important, the report also effectively explains that AI is not the only game in town, and, despite its seeming ubiquity and meteoric growth, it won’t be anytime soon, leaving plenty of room for growth for traditional data centers. According to the report:

- Traditional, lower-intensity workloads such as data storage and cloud-based applications still make up the majority of data center demand.

- Even optimistic adoption scenarios suggest that AI workloads may only grow to 50% of data center capacity by 2030.

- In 10 years, not every data center will be a specialized AI facility. In fact, only portion of data centers will be dedicated solely to AI applications. The majority of data centers will run a combination of traditional workloads and AI applications.

- Therefore, older data centers are not in danger of becoming obsolete. Instead, they will remain a valuable component of the global data center ecosystem.

- With data center technology constantly being upgraded, it’s just as common to see the latest generation NVIDIA GPUs in a newly constructed data center as it is in a 15-year-old colocation facility.

- Aside from the contractual lease agreements, the majority of a data center’s asset value lies within the existing power supply and the building’s infrastructure (electrical, plumbing, HVAC, generators, etc.).

- The in-place power supply is especially valuable given the current challenges securing power for new developments.

So, many thanks to the folks at JLL for reminding us that even as we drown in a sea of AI growth specifics, the rising data tide really is lifting all boats!

What do YOU think? Is there panic rising across the industry that the traditional data center growth story is being lost in all the talk of AI, GenAI, hyperscale, wholesale and the great technological march forward in our digital world? Comments always welcome!