DataCenter Hawk is out with its 1Q 2025 Data Center Market Recap, summarizing key trends throughout regional markets around the world during the quarter. Today we’ll focus on the North America and Latin America markets.

North America

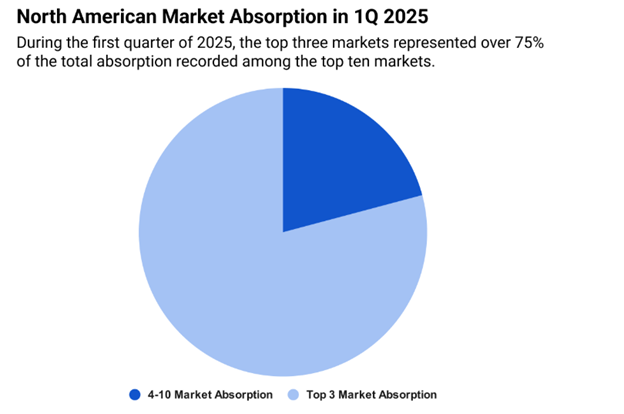

The North American first quarter data center market summary brought few surprises. Securing power remains the overarching challenge throughout the crowded US market, amid rapidly evolving demand patterns. As the below exhibit shows, when it comes to Tier 1 markets, there is simply no room at the inn. The top 3 markets – Northern Virginia (9.6 GW of capacity), Phoenix, AZ (2.8 GW) and Dallas-Fort Worth (2.4 GW) – together comprise three-quarters of the top 10 markets’ total recorded absorption.

As a result, companies looking to expand their data center footprint in the US must get creative in 3 ways:

1. Sprawl Adjacent to Existing Tier 1 Markets: While traditional Tier 1 markets like Northern Virginia (9.6 GW), Atlanta (2.3 GW), Phoenix (2.8 GW), and Dallas (2.4 GW) continue to receive interest, utility limitations in these core areas have created significant bottlenecks in delivering space and power. As a result, development is sprawling out from these hubs into adjacent cities and suburbs.

For Northern Virginia, this means areas south towards Richmond, north towards Martinsburg, WV, and across to Frederick, MD.

This sprawl is driven by the need to bolster cloud regions and support AI workloads.

Atlanta providers are even investing capital to shorten power delivery lead times by covering substation upgrade costs.

Dallas remains attractive partly due to the Electric Reliability Council of Texas (ERCOT)’s more flexible transmission expansion capabilities compared to markets bound by many regulations of the US agency that oversees the interstate transmission of electricity, natural gas and oil, the Federal Energy Regulatory Commission (FERC). ERCOT manages the grid for about 90% of Texas’ electric load and coordinates power flow to more than 26 million customers.

2. Secondary and Tertiary Markets: A major trend is the migration away from Tier 1 markets towards secondary and tertiary markets, where there is less power congestion.

Developers are turning to Columbus, OH, Reno, NV, both Kansas Cities (KS and MO), Charlotte, NC, Denver, Las Vegas, and the broader Portland, OR area. Richmond, VA is particularly attractive, due to its proximity to both subsea cabling and the I-95 corridor from Northern Virginia.

West Texas is seeing land banking, capitalizing on its abundance of natural gas power, which helps shorten lead times while waiting for grid power upgrades.

Secondary markets are anticipated to experience substantial growth, with providers following hyperscale users to these new regions.

3. Remote Areas for Specific Workloads: For certain use cases like low-latency LLM deployments, expansion is occurring in remote areas not near major metros or established data center markets. These locations benefit from even less power congestion.

However, these “non-market” builds can bring significant challenges, including labor shortages, limited housing, infrastructure constraints, and risks related to underwriting the data center’s long-term value.

The Takeaway

While data center demand is strong across the board from cloud, hyperscale, and AI companies, the decision of where to expand is heavily dictated by the feasibility and timeline of securing power.

Developers must find locations where power is more accessible or where they can implement creative power strategies like natural gas bridging or behind-the-meter generation to meet their speed-to-market needs. So, successful expansion involves navigating power constraints, either by finding locations with better power access (secondary/tertiary markets, West Texas, remote areas) or investing heavily to accelerate power delivery in constrained areas.

Latin America

DataCenterHawk’s Latin America Data Center Market Recap for 1Q 2025 was a fascinating view into the region’s challenges and opportunities – some unique to the current economic and geopolitical environment, and others representing issues that countries in the region have grappled with for years as they strive to build critical digital infrastructure to participate in global secular growth and development.

Current Demand Landscape: Opportunities – and Challenges – Abound

Just as they are in other regions, international data center markets are positioning themselves to support hyperscale AI training deployments in Latin America. However, several U.S.-based hyperscalers are temporarily pausing new development in Latin America due to factors like supply chain uncertainties, new tariffs, the rollout of next-generation NVIDIA chips and energy constraints in some areas.

Despite some pullback, demand is increasing from Chinese cloud providers expanding into key regional markets, specifically the region’s more developed markets: Mexico and Brazil. Latin America accounts for only 2% of global data center capacity, yet it grew 42% year-over-year in 2024, making it the fastest-growing region globally in percentage terms.

Energy access is a major driver and constraint throughout the region…

In Mexico, ongoing power shortages in Querétaro have significantly limited new deployments, prompting providers and hyperscalers to shift focus northward to cities with more reliable energy access like San Miguel de Allende (in the state of Guanajuato in central Mexico) and San Luis Potosí (in north-central Mexico).

On the other hand, Brazil has an energy surplus, exporting electricity, benefiting from 94% renewable electricity generation and a nationally interconnected electrical grid. Countries like Brazil are working to reduce deployment friction through national associations, pushing for lower import tariffs on chips, streamlining permitting and promoting renewable energy advantages.

…And economic challenges and regulatory barriers are difficult to navigate

Both Argentina and Brazil are actively working to attract AI infrastructure and investment by addressing economic hurdles and reducing market entry barriers. Argentina has taken steps like stabilizing inflation, launching the RIGI (Incentive Regime for Large Investments) initiative, and removing currency controls to open its economy to foreign capital and digital infrastructure investment.

Brazil is struggling with high interest rates (currently 14.25%, projected to rise), and making fiscal policy adjustments and currency stabilization efforts to reverse the trend. More critically, Brazil’s import tariffs on IT equipment and GPU chips can exceed 60%, creating a significant barrier for AI deployment. Reducing these tariffs is considered essential for Brazil’s competitiveness in attracting AI and data center expansion.

Hyperscalers are investing in next-generation subsea cables…

Advanced cloud and AI capabilities require high-capacity global connectivity. Hyperscalers like Google and Meta are increasingly deploying their own subsea cable systems due to aging infrastructure and cost inefficiencies of older telecom-built cables. Several hyperscale systems already connect Chile, Brazil, and Argentina to the U.S. New projects, like Google’s Humboldt (Chile to Australia) and Meta’s Project Waterworth (Brazil, U.S., etc.), are noted investments. These subsea cable investments will enhance regional cloud resilience and support long-term AI deployment.

…As well as renewable energy strategy

While hydroelectric power is dominant, persistent droughts highlight the need for diversification into solar and wind power. Companies like Amazon and OData are investing in solar and wind farms in the region. Brazil’s interconnected grid provides an advantage, allowing data centers to consume renewable power from farms in remote regions, unlike typical U.S. Renewable Energy Certificate (REC) purchases.

Looking Ahead

While the pace of absorption in Latin America slowed in Q1 2025 following record activity in 2024, the outlook remains strong, with a projected 3.5 GW of capacity currently in development across the region.

With a significant development pipeline and ongoing interest from hyperscalers in the region, Latin America is well-positioned for a rebound in demand and continued long-term growth in the second half of 2025. The OCOLO team did some digging beyond the datacenterHawk report and found some big numbers courtesy of Grand View Research, Inc.

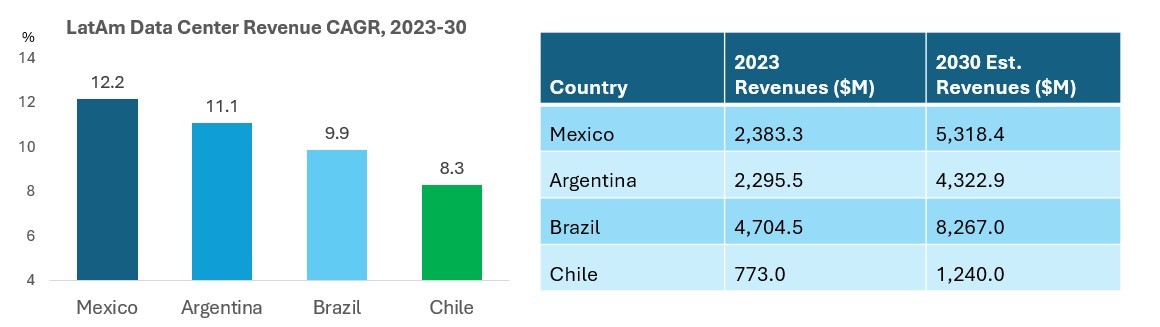

See below for the expected growth rates and revenue production in US dollar terms for the largest Latin American markets between 2023-30.

It’s clear that the largest international data center participants have been exploring growth opportunities in Latin America for years. The accelerating AI trend, coupled with the region’s abundant resources and increasingly supporting regulatory environment, suggest greater openness to mutually beneficial foreign investment than ever before.