Today, the McKinsey & Company Technology, Media & Telecommunications Team is out with a new article entitled: “AI power: Expanding data center capacity to meet growing demand,” outlining the many ways the data center industry must grow and evolve to accommodate the explosive growth and evolution of AI, GenAI and future AI iterations already in the works. Below, the OCOLO team shares the article’s main themes and highlights some of its most eye-popping charts, facts & figures and quotes.

Main Themes

- Exponential demand for AI-ready data centers: The rise of generative AI is driving a massive surge in demand for data centers capable of handling advanced AI workloads.

- Looming supply deficit: Existing data center capacity and planned expansions are unlikely to meet the projected demand, leading to potential shortages and rising costs.

- Unique requirements of AI workloads: AI, especially training large models, requires significantly higher power density and energy consumption than traditional data center applications.

- Evolving data center location strategies: Power constraints in traditional data center hubs are pushing operators to explore remote locations with abundant power resources.

- Innovation in cooling and power systems: Liquid cooling technologies and redesigned power architectures are becoming crucial to manage the heat and energy demands of AI workloads.

- Opportunities across the value chain: The rapid growth presents opportunities for data center operators, construction companies, equipment suppliers, and the energy sector.

Key Facts & Insights

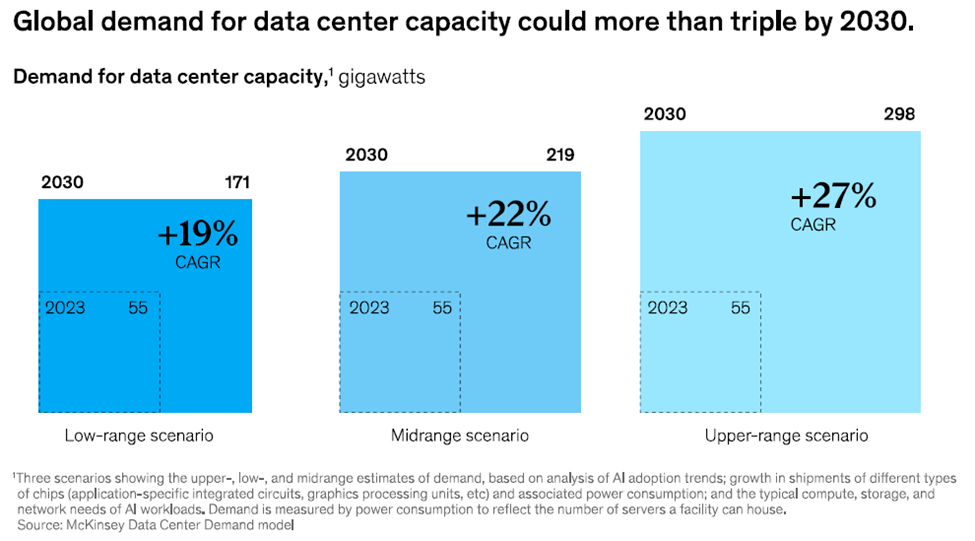

- Demand Growth: Global demand for data center capacity is projected to grow at 19-27% annually between 2023 and 2030, reaching 171-298 GW. Around 70% of this demand will be for AI-ready capacity.

- Supply Gap: Even with planned expansions, a supply deficit of more than 15 GW is projected in the US alone by 2030.

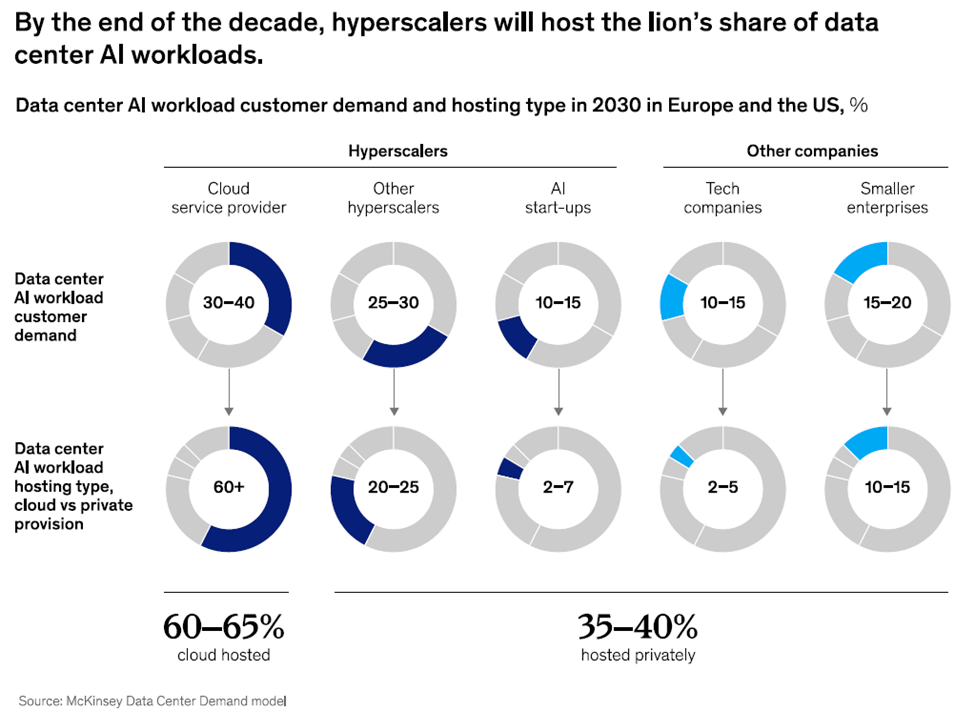

- Hyperscaler Dominance: Cloud service providers are driving most of the demand for AI-ready capacity, with 60-65% of AI workloads expected to be hosted on their infrastructure by 2030.

- Power Density Surge: Average power densities have doubled in two years to 17kW per rack and are expected to reach 30kW by 2027. Training workloads can demand more than 80 kW per rack.

- Shift in Location: Data centers are moving to remote locations like Indiana, Iowa, and Wyoming, where power is readily available, to address grid constraints in traditional hubs.

- Cooling Innovation: Liquid cooling technologies, particularly direct-to-chip and immersion cooling, are being adopted to manage the heat generated by high-power AI servers.

- Investment Required: More than a trillion dollars in investment will be needed across the data center ecosystem to scale infrastructure at the required pace.

Important Quotes

- “As challenging as this could be, companies and investors along the entire data center value chain have an opportunity to help address the looming capacity crunch—if they understand the requirements of data centers designed for the AI age.”

- “To avoid a deficit, at least twice the data center capacity built since 2000 would have to be built in less than a quarter of the time.”

- “Our analysis suggests that demand for AI-ready data center capacity will rise at an average rate of 33 percent a year between 2023 and 2030 in a midrange scenario.”

- “Data centers have exploded in size in terms of power consumption. Ten years ago, a 30-megawatt (MW) center was considered large. Today, a 200-MW facility is considered normal.”

- “The fact that not all AI workloads are equal has partly alleviated the power problem. When AI models are being trained, typical performance factors such as low latency and network redundancy are less important.”

- “They may have to move more quickly than they have in the past, given the pace of change in the sector.”

Opportunities & Challenges

- Colocation providers: Retrofitting existing centers and building new AI-ready facilities presents significant opportunities.

- Construction and equipment suppliers: The demand for modular construction and specialized equipment will fuel growth.

- Energy sector: Providing reliable, sustainable power solutions, including on-site generation, is crucial.

- Investment: Attracting significant capital to support rapid infrastructure development is essential.

- Collaboration: Partnerships across the value chain are needed to accelerate innovation and address capacity constraints.

Conclusion

The rapid rise of AI is transforming the data center landscape, creating both challenges and opportunities. Successfully meeting the unprecedented demand for AI-ready capacity requires a collaborative effort to address power constraints, adopt innovative technologies, and secure the necessary investments. The pace of this build-out will ultimately influence the speed of AI adoption and its impact on various industries.

Many thanks to the authors of this report:

Bhargs Srivathsan is a partner in McKinsey & Company’s Bay Area office, Marc Sorel is a partner in the Boston office, Pankaj Sachdeva is a senior partner in the Philadelphia office, Arjita Bhan is a knowledge expert in the Boston office, Haripreet Batra, CFA is an associate partner in the New York office, Raman Sharma is an alumnus of the Toronto office, Rishi Gupta is a consultant in the Chicago office, and Surbhi Choudhary is a consultant in the Seattle office.

In addition, the authors wish to thank Artem Shitov, Dave Sutton, Jesse Noffsinger, Matthew Cherry, Nicholas Shaw, Ruchika Dasgupta, Satyam Taneja, Shibashish Chakraborty and Wendy Zhu, PhD for their contributions to this article.