There’s been a lot of talk about the new tariffs announced by our current US Administration, and which trading partners and industries will be hurt the most by them. This includes a universal 10% tariff on most imports and higher, country-specific “reciprocal tariffs” that target nations with perceived significant unfair trade practices.

After significant turmoil in both the economic and stock markets across the US and multiple countries, the US government seems to have reached a détente with our largest trade partners… with one key exception: China. The general air of uneasiness and volatility won’t fully lift until uneasy negotiations with our friendlier partners and tense saber-rattling with China – the only country we are actively implementing the new tariff structure with today – are behind us.

Here at OCOLO, we’ve been asking ourselves 3 Questions:

- Which US trading partners are most affected?

- What goods and services are in the crosshairs?

- What’s the impact going to be on the digital infrastructure space?

Taking these questions one by one is an eye-opening exercise, as you’ll see in the exhibits below.

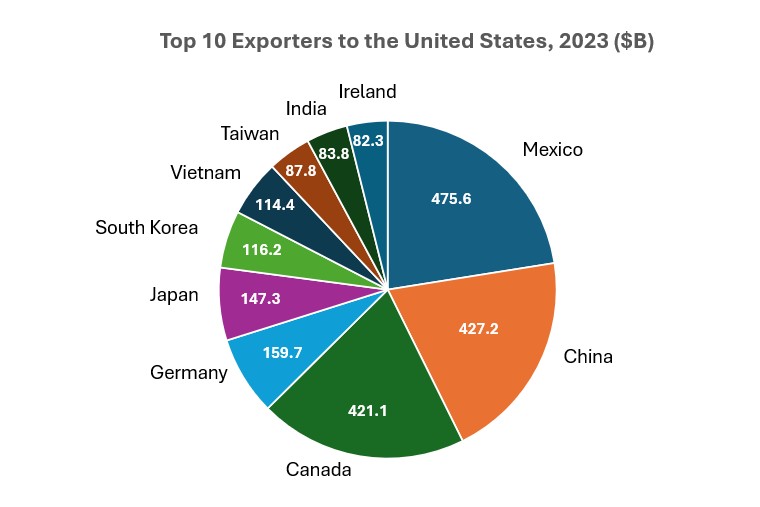

First, let’s tackle question #1 by looking at the “Pie of Pain” – The Top 10 Exporters to the US by dollar value as of full-year 2023 (latest available data)

There were a few surprises here for the team.

- We expected China to be the US’s largest exporter to the US, given all the rhetoric around the trade imbalance they maintain with us, as opposed to ranking #2 behind Mexico and just edging out #3 Canada. Still, these 3 countries together comprise 63% of the Top 10’s total $2.1 trillion in 2023 US exports.

- With combined exports worth nearly $900 billion to the US in 2023, Mexico and Canada don’t just represent 42% of what’s coming in from the Top 10; according to Reuters, around 77% of Mexico’s total exports and 75% of Canada’s go to the US – all the more reason our closest neighbors must maintain friendly trade relations with the US.

- We were surprised to see that just 2 European countries made the Top 10 – Germany and Ireland…

- …And that 6 of the top 10 exporters to the US were from Asia, including countries we wouldn’t associate with large US imports, like Vietnam (#7) and India (#9).

The more detailed table below delves more into the lineup. It also helps answer question #2 about what’s coming in, and question #3 about where digital infrastructure factors into all this. #3 spoiler alert: right smack dab in the center.

Key takeaways from the table above include:

- The US is the world’s top destination for cars, trucks, motorcycles, engines and auto parts – 9 of the top 10 countries spanning Europe, Asia and the Americas count items from this list among their largest US exports.

- Southeast Asia is a major semiconductor supplier to the US – Japan, South Korea, Vietnam and Taiwan all count semiconductors among their top US exports. Various industry estimates put the combined US total from these four countries at more than $80 billion in 2023

- One of these things is not like the others…As mentioned above, China, the #2 exporter to the US, is the only trading partner in our Top 10 that is actively being charged at the current 125% tariff rate. All the rest are on temporary suspensions, mostly 90 days. It’s not a surprise that the President is playing hardball: China’s trade surplus reached nearly $1 trillion in 2023. However, even though the US is China’s largest export market, the country is by no means over-reliant on Americans to buy their goods – the country actually ranks on the lower end in percentage of total exports to the US at 17%.

Finally, here’s our stab at question #3, the potential impact on digital infrastructure of these tariff changes.

We at OCOLO do not claim to be trade experts or economists, or even to fully grasp the full range of inputs necessary to develop the land, facilities, equipment, components and services that build, sustain and feed the massive growth of US digital infrastructure. In fact, even compiling a short list gets long fast:

- For data center construction – concrete, steel, machinery, equipment and fuel sources

- For data center equipment and accessories – steel, aluminum, plastics and polymers, glass, lithium & lead and liquid coolants for refrigeration

- For data center chips – silicon, copper, aluminum, gold, rare earth and other elements

- For sourcing, supply and servicing – a plethora of both rare earth elements and manufactured components way too long to list here.

Now, take a look at the table above again. Do you see any of these? Correction: Do you see ALL of these? Coming from ALL of our largest trading partners? We do too. The inputs necessary to build the digital infrastructure ecosystem come in large quantities from ALL of the US’s largest trading partners all over the world.

So, these tariffs have significant implications on both the US and global level for trade, supply chains and prices, particularly in the exploding digital infrastructure space. We know that the elevated tariff on Chinese goods is already creating stalled shipments and uncertainty among exporters that will only increase as the standoff between our two countries continues.

We’ll say it again: literally every aspect of the digital infrastructure ecosystem relies on countless materials that are produced naturally or are manufactured all over the world and then subsequently exported to where these ecosystems are built, expanded, sustained and expanded. Currently, the US is the largest digital infrastructure market in the world, by a wide margin. This end-to-end process is happening at an unprecedented pace today and as a society, we can’t afford to do anything that threatens its structural integrity, operational reliability, stability, security or scalability.

Let’s hope for reasonable compromises in the ongoing tariff negotiations for everyone’s sake. Comments? Share them!